How To Avoid Taxes On Retained Earnings

Regarding the mandatory repatriation tax there is unfortunately no way around it. Furthermore retained earnings from previous years are now subject to a one-off mandatory repatriation tax at a rate of 155 on retained earnings going back to 1986 held in cash or investments.

Retained Earnings Why Companies Retain Their Profits Getmoneyrich

Pre-tax income is as the name suggests the net pre-tax earnings of a corporation for a given tax year while retained earnings are the accumulated profits of the corporation after tax and may include capital.

How to avoid taxes on retained earnings. Say you invest 60000 in the firm and your two partners invest 30000 each you divide earnings 502525. As of the 2019 tax year individuals who make less than 39375 in taxable income and married couples who make less than 78750 do not pay federal taxes on qualified dividends and long-term capital gains. This applies to the earnings you withdraw and to the retained earnings.

The Basics of Dividend Tax Rules. Then add the net income or subtract net loss and then subtract cash dividends given to shareholders. It is critical to work with your attorney and tax advisor to consider all of the specifics when it comes to drafting and using trusts including trust taxation to avoid results that may differ from the original intent of your estate plan.

In other words the surest way to stay clear of the tax on accumulated taxable income is to maintain a company account balance below the level of those standard credits. No a negative retained earnings cannot be eliminated this way - although it will raise cash for the company and if the company is losing money or paying out too much in dividends then i. The IRS is going to get you one way or the other.

For example if an LLC is planning on expanding during the next tax year they may need excess cash for increased payroll or to acquire new machinery and equipment. Salary and bonuses can be deducted from corporate income tax but are taxed at the individual level. Retained earnings can be kept in a separate account and are tax-exempt until they are distributed as salary dividends or bonuses.

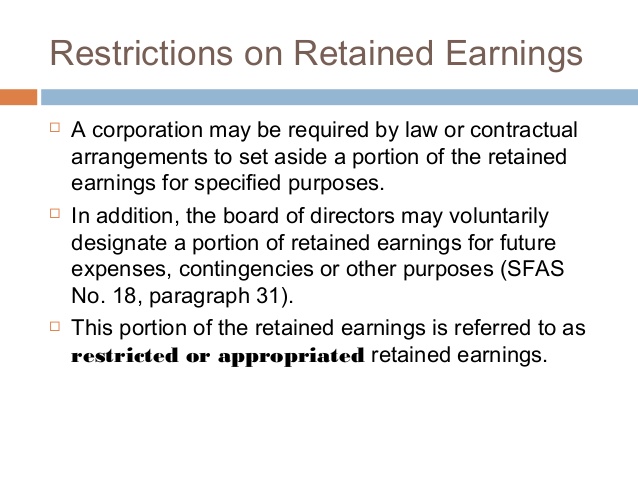

Answer 1 of 5. These are earnings calculated after tax-profit and therefore a company doesnt have to pay income taxes until a certain amount is saved. Some of the problems regarding retained earnings include the following.

To avoid paying excess retained earnings taxes dont try to avoid paying income taxes by retaining excess retained earnings. Even though the tax rate on accumulated taxable income is 20 it would have risen to 396 thanks to the intervention of the American Taxpayer Relief Act ATRA that prevented it from rising to such a higher rate. Depreciation has to be included in your net income calculation and is therefore part of your retained earnings balance.

If a company does not distribute any dividends by keeping a portion of retained earnings as accumulated earnings shareholders are able to avoid this tax. If the IRS decides that a business has excess earnings the company will be liable for income tax on that amount at the rate of 15 percent with interest calculated from the date of. Theres not a single business out there that can succeed without keeping close tabs on its balance sheet and one way to gauge a companys financial health is to take a.

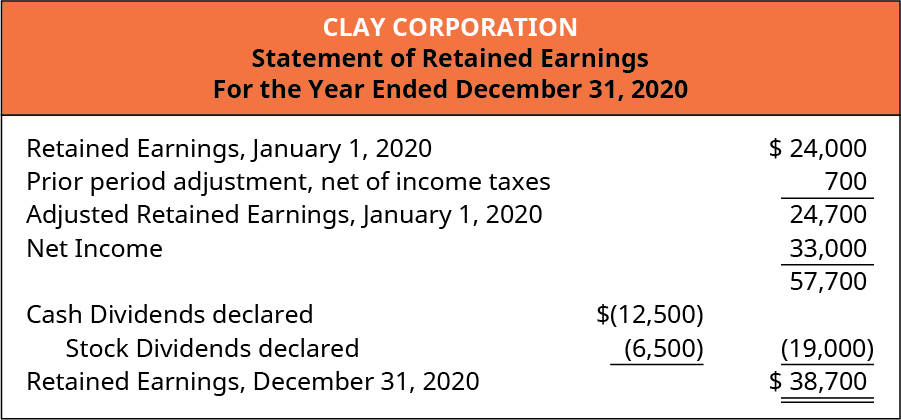

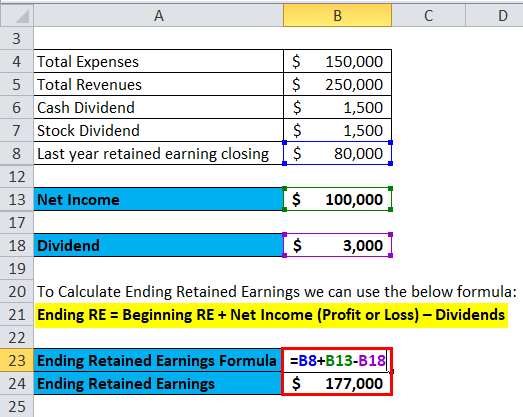

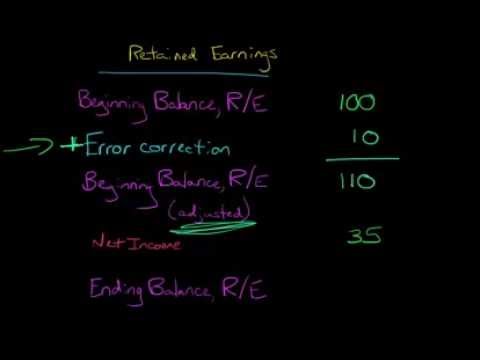

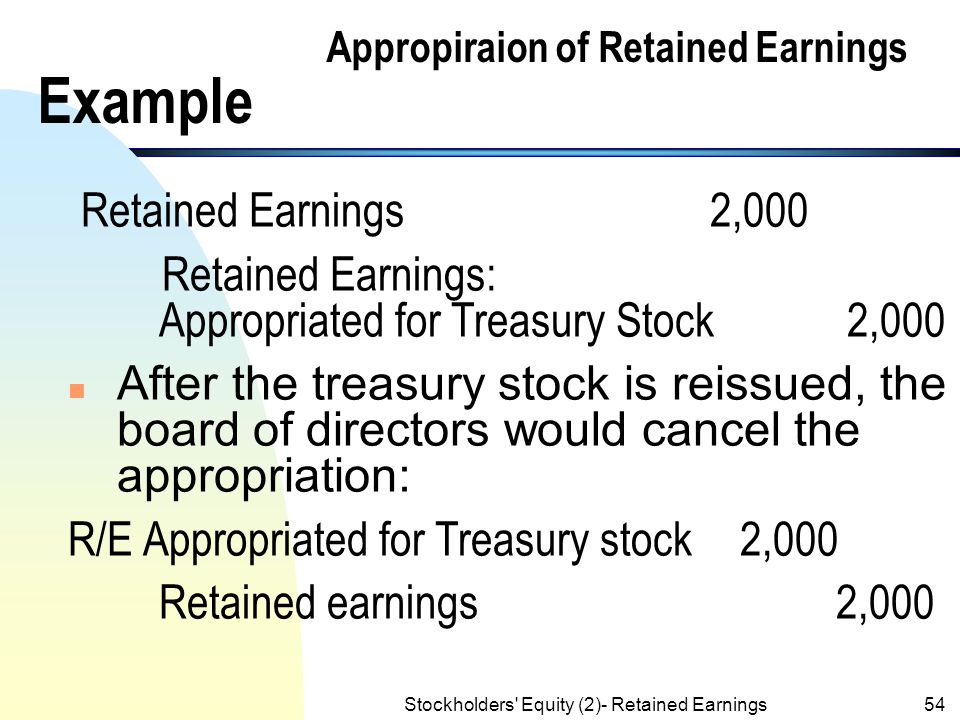

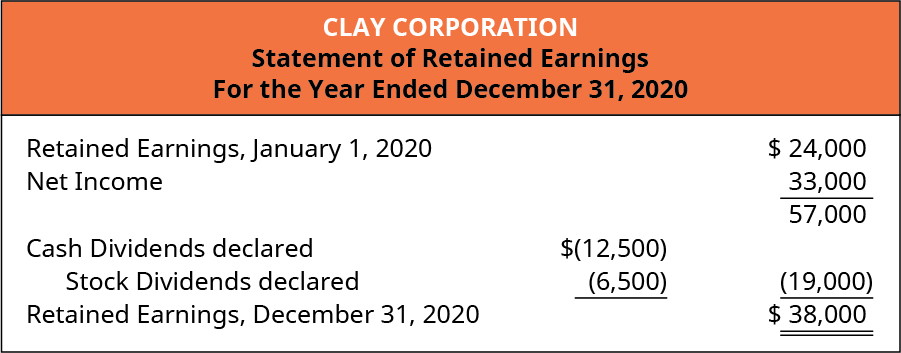

Shareholders are taxed on a percentage of the profits whether or not they end up receiving the money thereafter. You will need to document how you plan to allocate retained earnings. How to Calculate Retained Earnings.

One way to avoid double taxation is simply to retain corporate earnings. Problems on Retained Earnings. What steps can US expats take to mitigate the affects of GILTI.

Like it or not companies live or die based on their financials. After all the higher your depreciation expense the lower your net income is. Exceptions to Retained Earnings Tax The IRS permits exceptions to the retained earnings tax but a corporation will need to show there is a business justification for the retained earnings.

This she argues justifies the recognition of a community interest in the retained earnings. State taxes may still apply but even in states with higher tax rates paying no federal taxes remains a huge benefit. The tax rate on accumulated taxable income currently stands at 20 and fortunately the American Taxpayer Relief Act ATRA kept it from rising to a much higher scheduled rate of 396.

This carries over to a lower retained earnings balance and lower owners equity. The value of the stock increases as retained earnings increases. Another reason for corporations to retain earnings is to expand its business.

If no profit is recorded no income tax is paid. A business that plans to expand upgrade equipment or invest in restocking inventory can offer a business justification for using retained earnings and may be able to waive additional taxes. Subtract the portion of the income distributed to shareholders to identify the closing balance for the retained earnings account.

Dividends can be taken out at a later time thereby reducing the net present value of the tax or the shareholders can sell the company for a higher price. By retaining the income rather than distributing it to shareholders as dividends the second layer of taxation can be avoided. The court in the final Holtzman decision differed from the previous two by focussing on pre-tax income rather than retained earnings.

One of the most effective ways to avoid taxes on accumulated income is to have your firms account balance below the given threshold. Appellee contends however that retained earnings of a Subchapter S corporation should be treated as community property because the community has paid federal income tax on them. Start with retained earnings from last periods balance and add or subtract prior period adjustments which will equal the adjusted beginning balance.

For non-grantor trusts income distributions may greatly reduce the overall amount of income tax liability owed depending on the tax situation of the beneficiary. How do you avoid tax on retained earnings. Retained earnings can be kept in a separate account and are tax-exempt until they are distributed as salary dividends or bonuses.

Dividends are not tax-deductible. Can negative retained earnings be eliminated through a cash contribution to the corporation.

A Retained Earnings Statement Is Used By Accountants To Also Keep Track Of A Tax Payer S Accounts Sales Report Template Statement Template Report Template

Negative Retained Earnings Definition And Explanation Bookstime

Everything You Need To Know About Retained Earnings Bookstime

Retained Earnings Definition Example Simple Accounting

Corporations Effects On Retained Earnings And The Income

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

How Are Retained Earnings Recorded Online Accounting

Retained Earnings Definition Example Simple Accounting

What Is Retained Earning S Normal Balance Accounting Services

Retained Earnings Why Companies Retain Their Profits Getmoneyrich

Retained Earnings Account Is Missing

How To Prepare Retained Earnings Statement Example Format Bookstime

Compare And Contrast Owners Equity Versus Retained Earnings Principles Of Accounting Volume 1 Financial Accounting

Retained Earnings Account Is Missing

Everything You Need To Know About Retained Earnings Bookstime

Retained Earnings Why Companies Retain Their Profits Getmoneyrich

What Are Retained Earnings How To Calculate Retained Earnings Mageplaza

How To Prepare Retained Earnings Statement Example Format Bookstime

Post a Comment for "How To Avoid Taxes On Retained Earnings"