How Does Nol Carryback Work

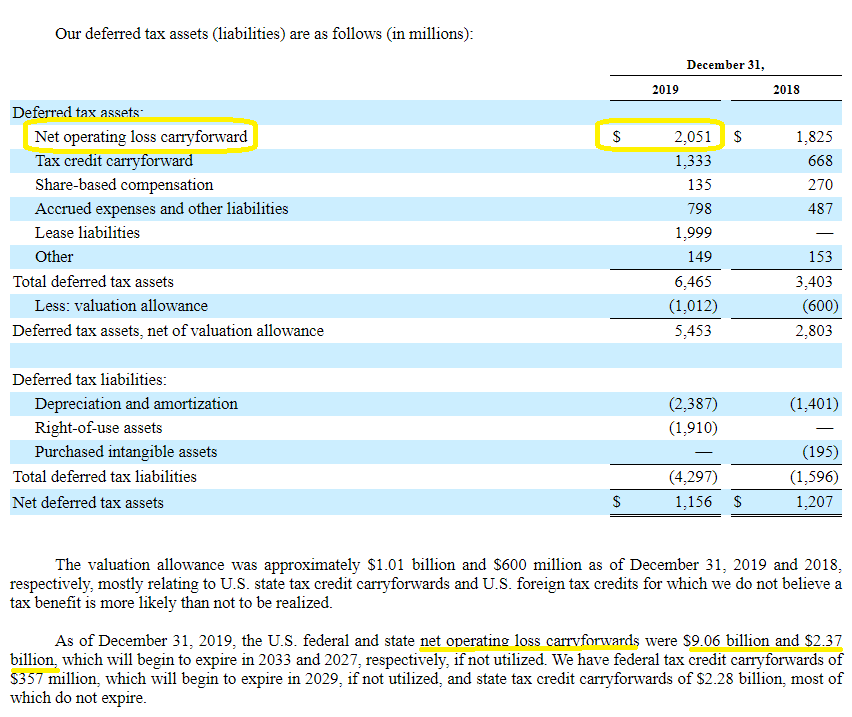

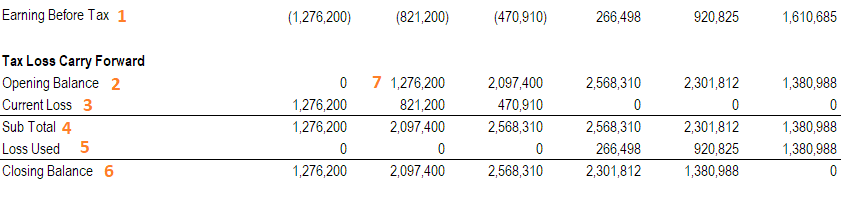

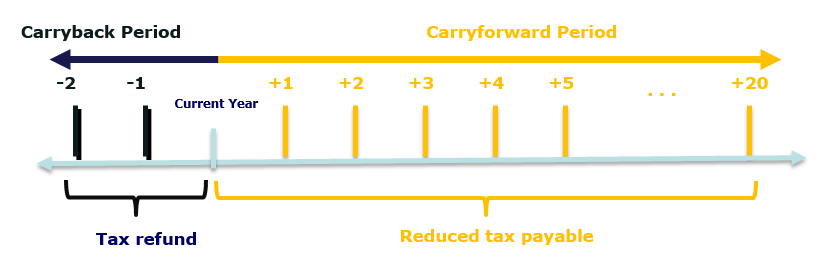

A Net Operating Loss NOL or Tax Loss Carryforward is a tax provision that allows firms to carry forward losses from prior years to offset future profits and therefore lower future income taxes. Net operating loss carrybacks and carryforwards allow a taxpayer to recognize a net operating loss in a tax reporting period other than the current period.

Net Operating Loss Carryback Carryforward With Valuation Allowance For Tax Benefit Due Dta Youtube

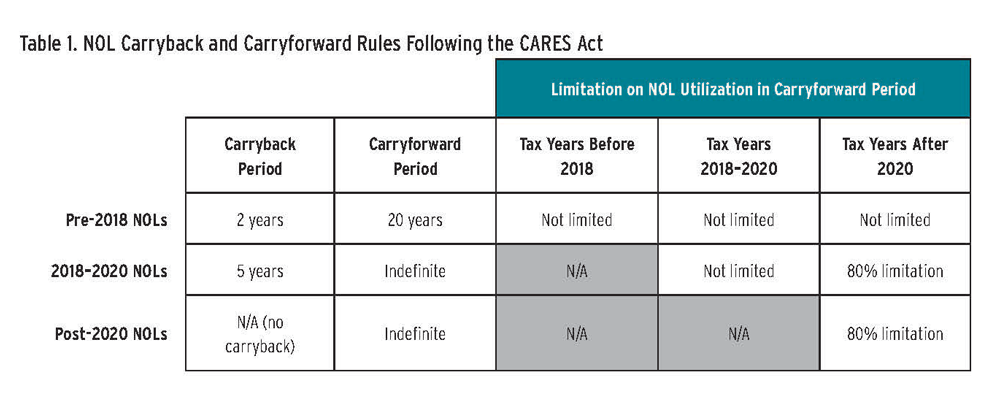

Effective for tax years beginning Jan.

How does nol carryback work. 172 b 3. 2013 through 2018 NOL can be carried back to each of the past 2 years. 1 2021 to each of the five taxable years preceding the taxable year of the loss.

Net Operating Loss and Change in Marital Status. Section 281 amended the CARES Act by adding new section 2303 e specifically addressing farming loss NOLs. When you carryback an NOL you must recompute your new tax liability in that year by taking into account the NOL deduction.

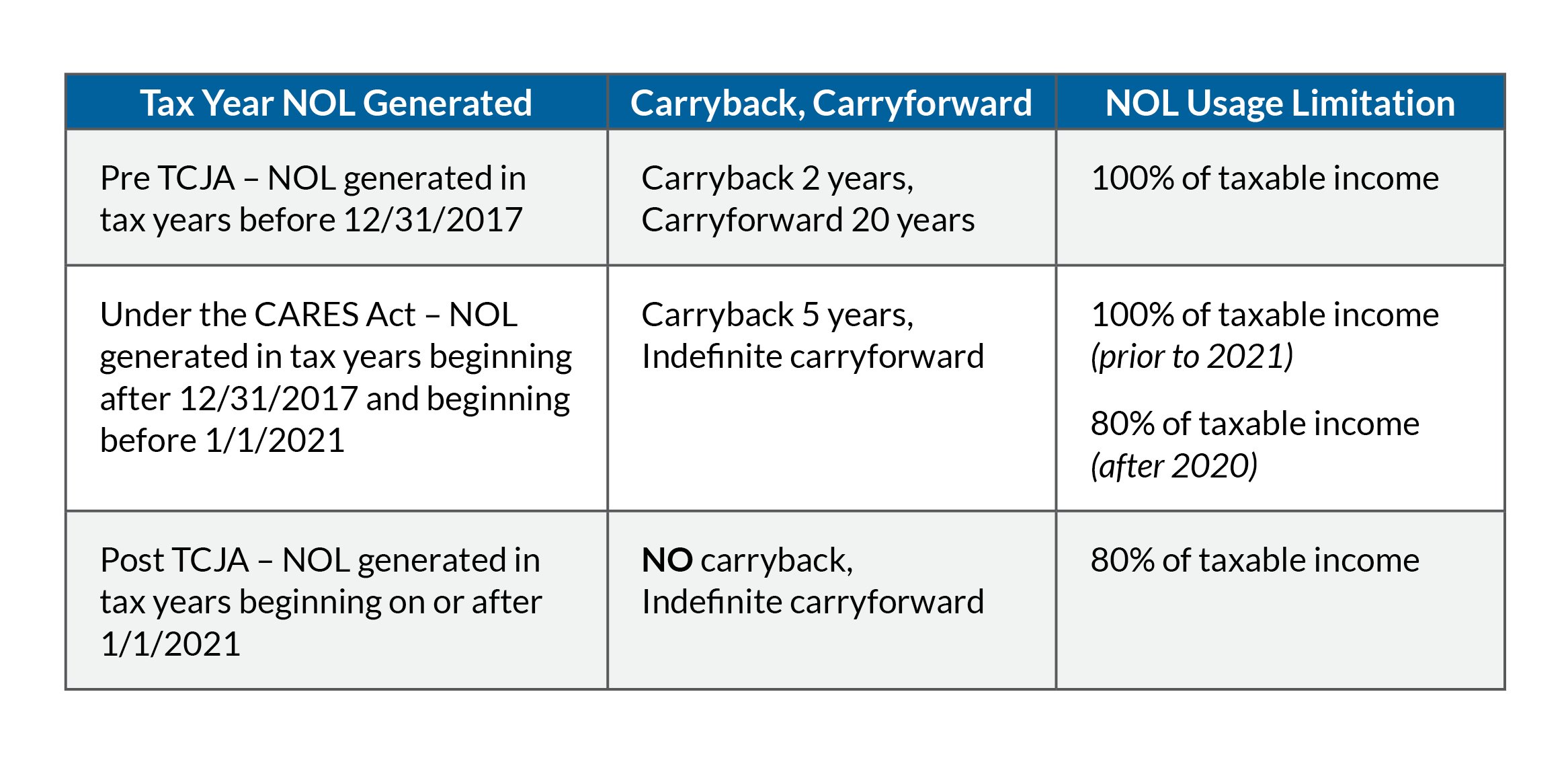

Refer to this article for instructions on making a copy of a client return. The Coronavirus Aid Relief and Economic Security Act CARES Act amended section 172b1 to provide for a carryback of any net operating loss NOL arising in a taxable year beginning after December 31 2017 and before January 1 2021 to each of the five taxable years preceding the taxable year in which the loss arises carryback period. The Act amends section 172 b to allow for the carryback of losses arising in a taxable year beginning after Dec.

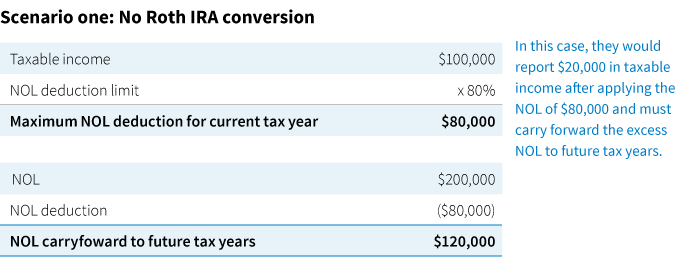

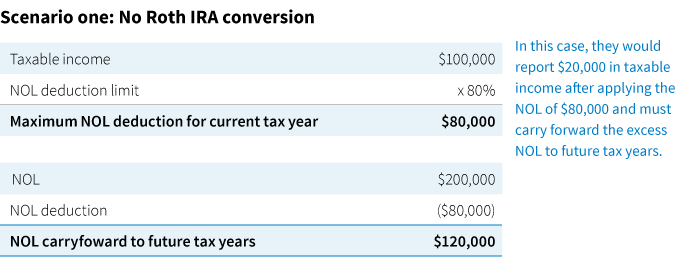

If your marital status in the NOL year is different from your marital status in the carryback or carryover year the spouse who has the NOL can claim it. The maximum loss you can carry forward for a year is 80 of taxable income modified by removing some deductions. S and carryforward any excess.

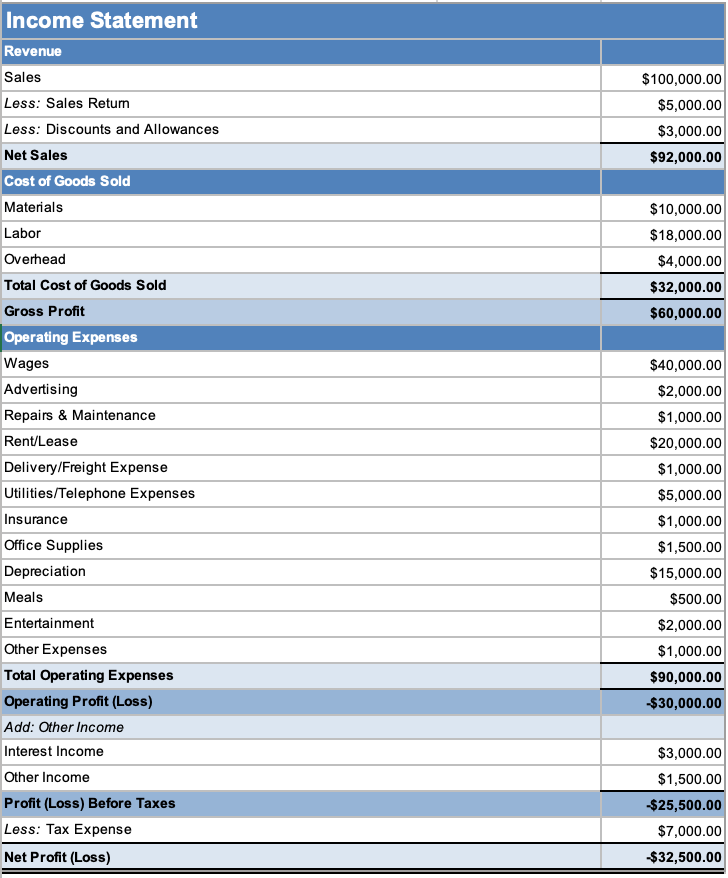

When a business reports operating expenses on its tax return that exceed its revenues a net operating loss NOL has been created. Accounting For Income Taxes Income taxes and their accounting is a key area of corporate finance. If anything is leftover of the NOL after the carryback you can carry it.

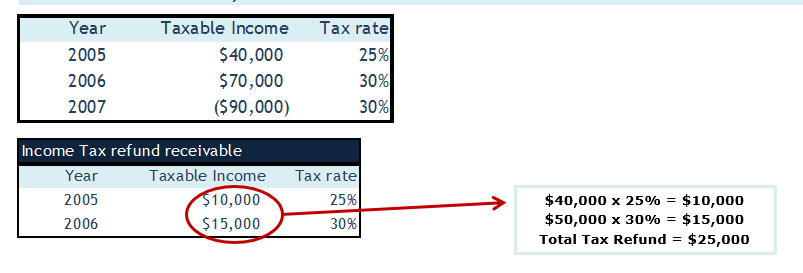

Carryback your NOL deduction to the past 2 tax years by filing your amended return. Usually the net operating loss can be carried back to the two tax years before the NOL year and applied against any taxable income to get an immediate tax refund. You were divorced in 2012.

This discussion focuses on how the alternative minimum tax AMT rules impact the net operating loss NOL rules under the CARES Act. Up to 10 cash back A taxpayer generally must file an election to waive an NOL carryback period by the due date including extensions of the income tax return for the year in which the NOL arose Code Sec. For example the NOL for 2017 may be carried back to 2015 or 2016.

2019 and after NOL can no longer be carried back to the past 2 years. 31 2017 and before Jan. 116-136 enacted March 27 2020 amended section 172b1 to provide for a carryback of any NOL arising in a tax year beginning after December 31 2017 and before January 1 2021 to each of the five tax years preceding the tax year in which the loss arises.

If you do have an actual NOL however you can carry it back to prior tax years to generate a refund. For losses incurred in tax years. Use Form 1045 to compute the decrease in your tax for the carryback year.

The Coronavirus Aid Relief and Economic Security Act CARES Act Pub. A Net Operating Loss NOL Carryback allows businesses suffering losses in one year to deduct them from previous years profits. NOL works the same way no matter what the business source is.

This results in an immediate refund. NOLs incurred in 2020 for example must be carried back five years unless you elect to forego the carryback which is mandatory. Create a copy of the return with a new name.

Follow these steps to enter an NOL carryback using the 1040-X. An NOL can be used in some other tax reporting period as an offset to taxable income which reduces the tax. In certain cases the NOLs have a greater carryback period.

If you file a join return the NOL deduction is limited to the income of the spouse who had the NOL. The June 30 2021 guidance details the procedures for making these elections and revocations. The FAQs posted May 27 2020 note that the IRS.

Carryback other than for special 5-year carrybacks effective for taxable years beginning after December 31 2017 Special carryback does not apply to NOLs generated by REITs Life insurance company carrybacks to years beginning before January 1 2018 treated as 810 operations loss carryback. This keeps the original file intact. 1 2018 the Tax Cuts and Jobs Act TCJA changed the historic NOL carryback rules.

The TCJAs changes to NOLs and the AMT Prior to the TCJA Sec. Businesses thus are taxed on their average profitability making the tax code more neutral. The NOL changes were one of the primary revenue raisers in the TCJA to help offset the cost of lowering.

First after you determine that you have an eligible loss in your S-Corp because a deductible loss CANNOT exceed your actual basis in the corporation you would determine your Net Operating Loss carryback amount. It also allows farmers to revoke a prior election to waive a carryback for the 2018 and 2019 tax years. The IRS provided guidance on how taxpayers who want to elect to waive or reduce the new provision requiring taxpayers with net operating losses NOLs arising in tax years beginning in 2018 2019 and 2020 to carry them back five years Rev.

6411 to carry back an NOL that. A loss carryback describes a situation in which a business experiences a net operating loss NOL and chooses to apply that loss to a prior years tax return. The net operating loss NOL carryback rules have changed over time frequently becoming more taxpayer favorable during times of economic crises.

Open the return that you want to amend. You may have NOL for the year if your adjusted gross income on your tax return is less than your deductions the standard deduction or itemized deductions. The IRS also extended the deadline for filing an application for a tentative carryback adjustment under Sec.

172 provided that NOLs could be carried back two years and carried forward 20 years to offset taxable income generated in those periods. You should receive a refund. In the US a Net Operating Loss cannot be carried back only carried forward.

However the IRS allows taxpayers to file late waivers for NOLs arising in tax years beginning in 2018 or 2019.

Nol Carrybacks Under The Cares Act Tax Executive

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Nol Carryback Claims Can Unlock Closed Statute Of Limitationyears

A Small Business Guide To Net Operating Loss The Blueprint

Corporate Net Operating Loss Carryforward And Carryback Provisions By State Tax Foundation

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Net Operating Loss Definition Carryforwards Carrybacks

Corporate Net Operating Loss Carryforward And Carryback Provisions By State Tax Foundation

Net Operating Loss Definition Carryforwards Carrybacks

Nol Carrybacks Limited By Excess Distributions

Taxalmanac A Free Online Tax Research Resource And Community Discussion Nol Carryback Freeing Previously Suspended Passive Losses

Cares Act Five Year Nol Carryback Rules Will Have Significant Impact On M A Transactions Lexology

Rules For Nols Change Under Tax Reform Putnam Wealth Management

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Net Operating Loss Carrybacks And Carryforwards In Financial Accounting Youtube

Cares Act International Tax Implications Of Nol Rule Changes Rkl Llp

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Post a Comment for "How Does Nol Carryback Work"