Net Operating Loss Carryback 2019

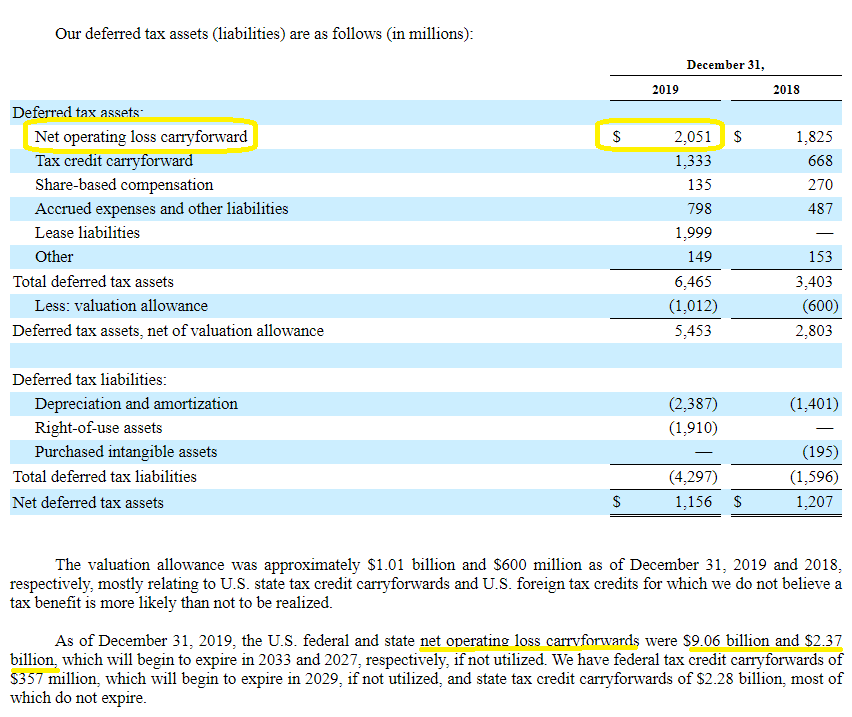

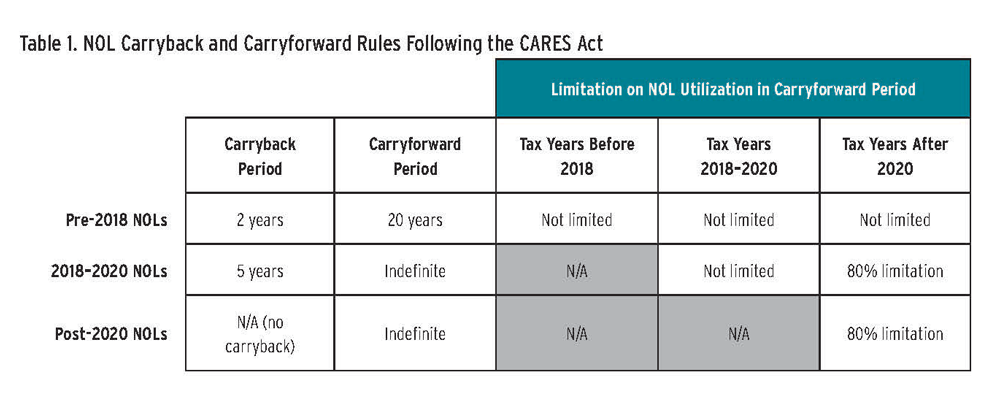

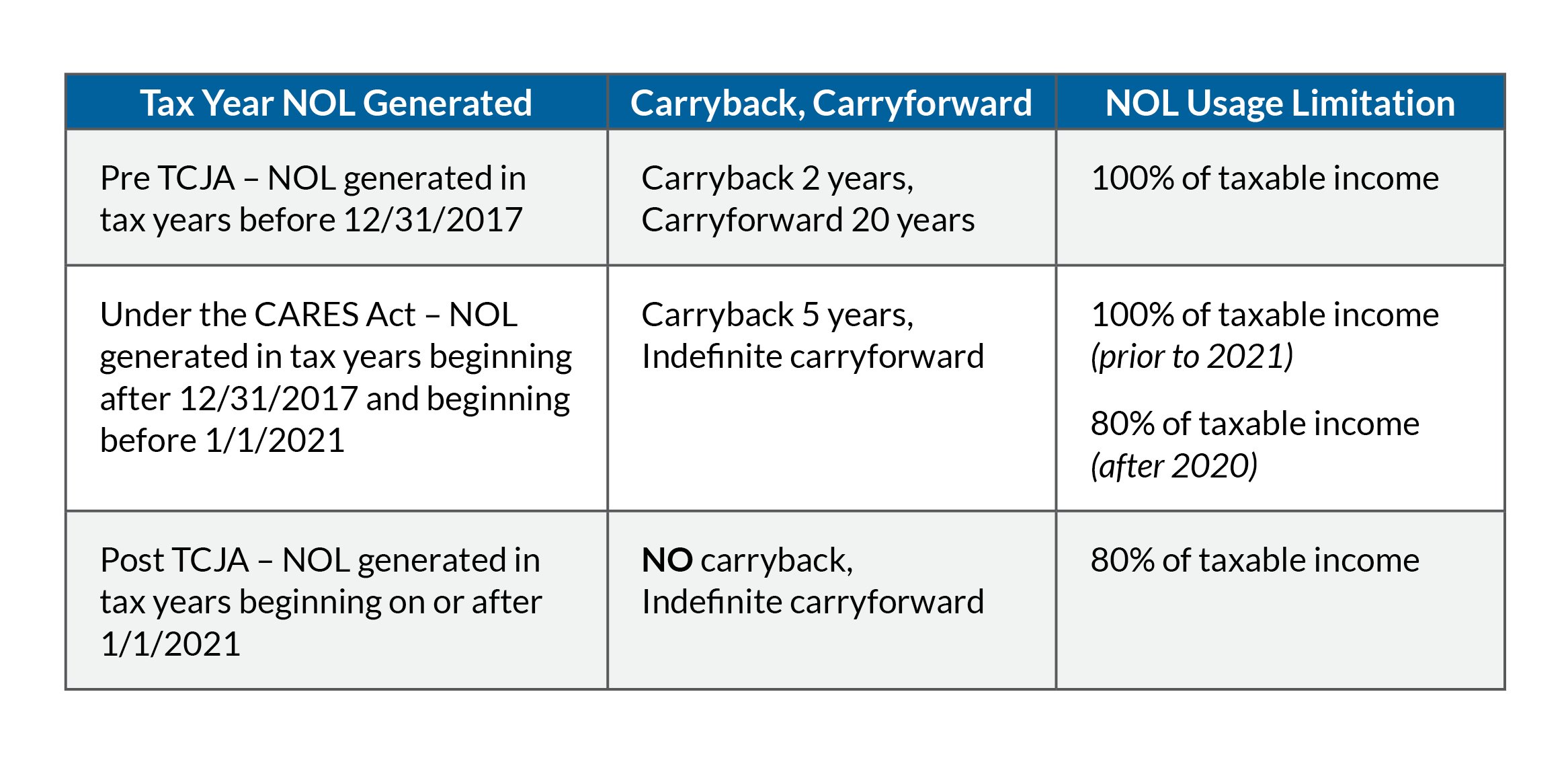

ABCs 200000 NOL carryforward from 2018 can be used to offset its 2019 income as follows. Section 2303 of the CARES Act 1 made several changes to the tax law regarding net operating losses arising in tax years beginning after December 31 2017 and ending before January 1 2021.

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

Under the CARES Act a taxpayer must carry back an NOL generated in 2018 2019 or 2020 to the earliest year in the five-year carryback period.

Net operating loss carryback 2019. 965 years from the carryback period for an NOL arising in a tax year beginning in 2018 2019 or 2020. For most taxpayers NOLs arising in tax years ending after 2020 can only be carried forward. 2 One change provides that NOLs arising in 2018 2019 or 2020 must be carried back to the earliest of the preceding five years and that after that carryback any remaining unused portion of.

CARES Act Adds Five-Year Carryback Period and Suspends 80 Limitation for 2018 2019 and 2020 Net Operating Losses. How do I report a net operating loss carryforward. The CARES Act provided for a special 5-year carryback for taxable years beginning in 2018 2019 and 2020.

Exceptions apply to certain farming losses and NOLs of insurance companies. The IRS also extended the deadline for filing an application for a tentative carryback adjustment under Sec. Iowa net operating losses are generally carried back two years except for losses incurred in Presidentially-declared disaster areas 3-year carryback and losses incurred by individuals engaged in farming 5-year carryback.

However you may file an election to either waive the entire five-year carryback period or to exclude all of your section 965 years from the carryback period. For a limited time 2018 2019 and 2020 NOLs can be carried back for up to five years. The 2-year carryback rule in effect before 2018 generally does not apply to NOLs arising in tax years ending after December 31 2017.

6411 to carry back an NOL that. To amend the Internal Revenue Code of 1986 to allow certain taxpayers a 2-year carryback of net operating losses and to restore and make permanent the limitation on excess business losses of non-corporate taxpayers. The IRS provided guidance on how taxpayers who want to elect to waive or reduce the new provision requiring taxpayers with net operating losses NOLs arising in tax years beginning in 2018 2019 and 2020 to carry them back five years Rev.

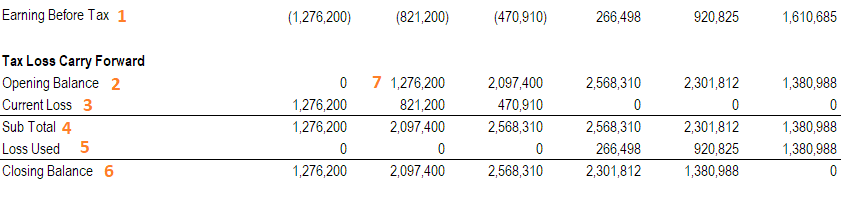

The CARES Act removed the restrictions on tax loss carryback for tax years 2018 2019 and 2020. Taxpayers can carry back NOLs including non-farm NOLs arising from tax years beginning in 2018 2019 and 2020 for 5 years. If the earliest years taxable income cant absorb all or part of the NOL then the taxpayer carries forward any remaining NOL to the next carryback year with taxable income and so on until the NOL used up.

Prior to this CARES Act amendment the TCJA had eliminated carrybacks and permitted NOLs to be carried forward indefinitely for post-2017 NOLs. This deduction can be carried back to the past 2 years andor you can carry it forward to future tax years. Generally you are required to carry back any NOL arising in a taxable year beginning in 2018 2019 or 2020 to each of the five taxable years preceding the taxable year in which the loss arises.

Those taxpayers may elect under Sec. The election for an NOL arising in a tax year beginning in 2018 or 2019 must be made no later than the due date including extensions for filing the taxpayers federal income tax return for the first tax year ending after March 27 2020. If your deductions and losses are greater than your income from all sources in a tax year you may have a net operating loss NOL.

Any taxpayer entitled to a carryback period under paragraph 1 may elect to relinquish the entire carryback period with respect to a net operating loss for any taxable year. That enhances flexibility for tax planning that did not exist before the pandemic. The CARES Act revived the NOL carryback that was previously eliminated by the Tax Cuts and Jobs Act of 2017 TCJA.

In summary Notice 2020-26 grants corporations a six-month extension to file an application for a tentative refund on Form 1139 or Form 1045 for individual taxpayers trusts and estates for the carryback of an NOL that arose in a year that began during calendar year 2018 and ended on or. 172b1DvI to exclude all Sec. Section 2303 of the Coronavirus Aid Relief and Economic Security Act CARES Act revised the provisions of the Tax Cuts and Jobs Act TCJA section 13302 for tax years 2018 2019 and 2020.

Net operating losses in 2021 or later may not be carried back and must be carried forward. Under the CARES Act a business can now carry back 100 of its net operating losses for tax years 2018 2019 and 2020 for up to five years and may claim a refund based on that adjustment for any or all taxes paid. Summary of HR6579 - 116th Congress 2019-2020.

ABCs taxable income for 2019 before NOL deduction is 100000. You may be able to claim your loss as an NOL deduction. Such election shall be made in such manner as may be prescribed by the Secretary and shall be made by the due date including extensions of time for filing the taxpayers return for the taxable year of the net.

CARES Act Adds Five-Year Carryback Period and Suspends 80 Limitation for 2018 2019 and 2020 Net. For tax years starting after December 31 2017 and before January 1 2021thats 3 calendar years of losses that you incurred in 2018 2019 or. See IA 123 pdf for further guidance regarding carrybacks and carryforwards.

Section 2303 of the CARES Act suspends the 80 of taxable income limit on NOL carryovers for 3 years. The CARES Act has modified the carryback rule for net operating losses generated in tax years that begin in 2018 2019 and 2020. Taxpayers can carry back NOLs includ- ing non-farm NOLs arising from tax years be- ginning in 2018 2019 and 2020 for 5 years.

In Notice 2020-26 PDF the IRS grants a six-month extension of time to file Form 1045 or Form 1139 as applicable with respect to the carryback of a net operating loss that arose in any taxable year that began during calendar year 2018 and that ended on or before June 30 2019. On March 27 2020 President Trump signed into law the Coronavirus Aid Relief and Economic Security Act HR. If you carry forward your NOL to a tax year after the NOL year list your NOL deduction as a negative figure on the Other income line of Schedule 1 Form 1040 or Form 1040NR line 21 for 2018.

The Bottom Line. A net operating loss generated in these years can be carried back for five years. Those losses that arent used in prior.

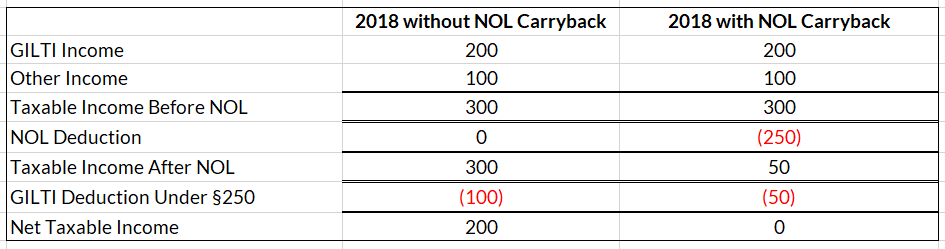

Cares Act Relief May Result In Difficult Choices For Multinational Taxpayers Insights Vinson Elkins Llp

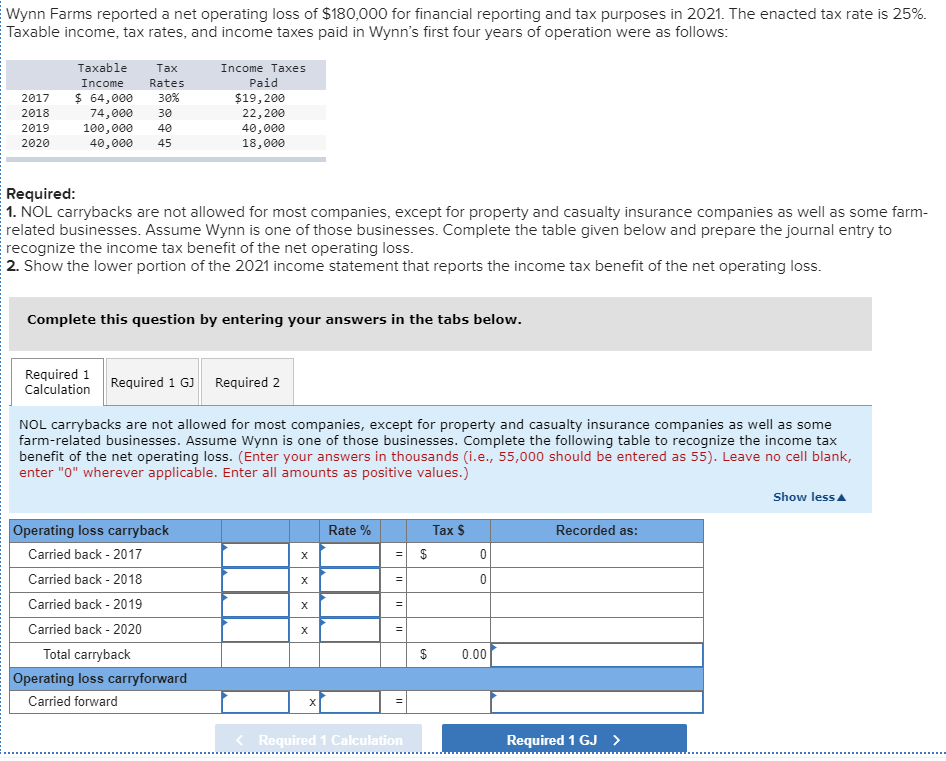

Solved Exercise 16 25 Algo Net Operating Loss Carryback Chegg Com

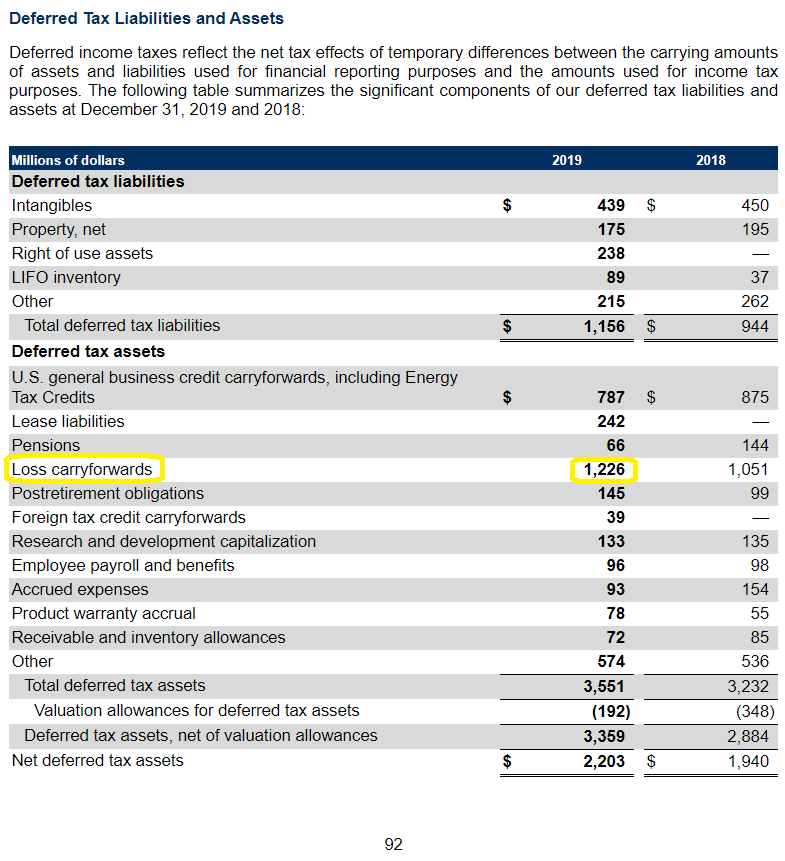

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Solved C D 1 Dividends Received Deduction And Net Operating Chegg Com

Cares Act Relief May Result In Difficult Choices For Multinational Taxpayers Vinson Elkins Llp Jdsupra

1040 Net Operating Loss Faqs Nol Schedulec Schedulee Schedulef

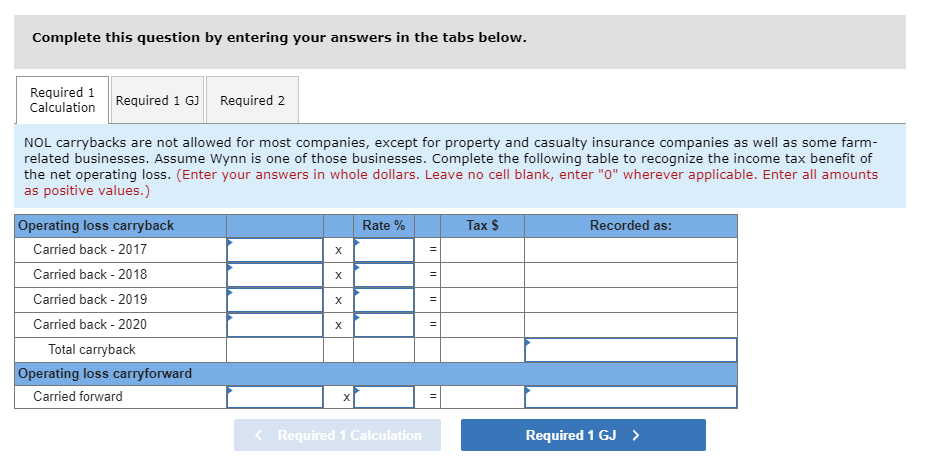

Solved Wynn Farms Reported A Net Operating Loss Of 180 000 Chegg Com

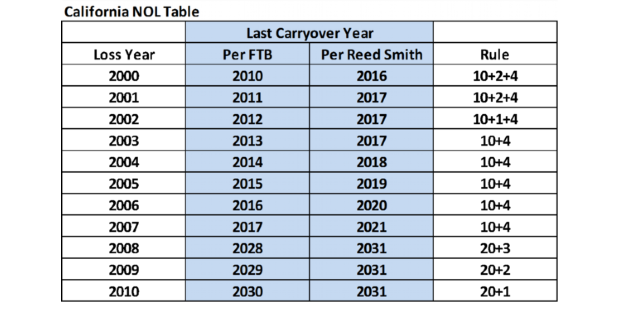

California Net Operating Loss Opportunities Perspectives Reed Smith Llp

Net Operating Loss Nol Carryover Deduction San Jose Cpa

Cares Act International Tax Implications Of Nol Rule Changes Rkl Llp

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Nol Net Operating Loss Carryforward Explained Losses Become Assets

Nol Carrybacks Under The Cares Act Tax Executive

Tax Loss Carryforward How An Nol Carryforward Can Lower Taxes

Net Operating Loss Carrybacks And Carryforwards Tax Foundation Of Hawaii

Cares Act International Tax Implications Of Nol Rule Changes Rkl Llp

A Small Business Guide To Net Operating Loss The Blueprint

Post a Comment for "Net Operating Loss Carryback 2019"