Is Election Worker Pay Taxable

Is poll worker pay taxable. To become an election worker review the Election Worker Flyer and complete the Election Worker Application.

A for an essential worker who is not a highly-compensated essential worker 10000 reduced by employer payroll taxes with respect to such premium pay.

Is election worker pay taxable. Election workers wages are includible in gross income as compensation for services. However if you earned more than 600 in wages for your election work election workers should get a W-2. The good news is that poll workers are paid for their time on election day.

Income Tax Withholding Compensation paid for services and reimbursements paid under a non-accountable plan are taxable to election workers. Individual Income Tax Return even if you do not receive an IRS Form W-2 Wage and Tax Statement for this work. Election workers may be compensated by a set fee per day or a stipend for the election period.

Return the completed application to electionworkersoslagov send to your parish Clerk of Courts Office or the address below. Will I get a tax slip for my work Record of Employment T4 Relevé 1. See note below for the current and.

Or B for a highly-compensated essential worker 5000 reduced by employer payroll taxes with respect to such premium pay. Individual Income Tax Return even if you do not receive an IRS Form W-2 Wage and Tax Statement for this work. Poll workers generally work all day on election day from before the polls open at 700 am.

However a poll worker may elect to withhold income tax from their pay by submitting form W-4 to their employer. Enter at Business Income Expenses and TurboTax TT. A state and the Social Security.

Great job for teenagers needing experience nice staff only downside was long shift and some of the voters were cranky. The parish Clerk of Courts office or registrar will contact you with your next steps. Setting up an election worker in MARGE Payroll Under Employee Employee Maintenance click on the Insert button to insert a new employee.

Make sure you are eligible to serve as an election worker. An individual employed as an election worker may also perform services for the government in another capacity. The worker works for less than 35 hours in a calendar year.

Under New Jersey law NJSA. Governments typically pay election workers a set fee for each day of work. 16 rows To receive payment workers must provide their social security number prior to working the.

Until after the polls close at 800 pm. You can serve as an election worker if you meet these requirements. Any compensation you receive as a poll worker is to be reported as taxable on your IRS Form 1040 US.

You are not a candidate or a member of a candidates immediate family. If they are taxable t he IRS considers undocumented cash income no W-2 or 1099-MISC for work performed to be self employment income. Both are paid a stipend for their time.

Under Tax Data indicate YES to be Exempt from. The training course had guaranteed pay and it was only 1 day with a near 14 hour shift. Vote Center locations typically staff four to six election workers on Election Day.

You are a registered voter in the State of Michigan if you are 18 years old or older. However they arent subject to income tax withholding under Internal Revenue Code IRC Section 3401 a. 18 years of age or older unless participating in the Student Election Worker Program A.

The worker is not a regular employee of the government body. Pay rates for all federal election workers are set by the Federal Election Fees Tariff. If you were assigned to an office staff position or worked 35 hours or more as a poll official you will receive a Record of Employment.

Unlike compensation from a permanent job poll workers income is not automatically subject to income tax withholding. From January 1 2020 forward the Federal Insurance Contributions Act FICA tax exclusion for election officials and election workers is 1900 a calendar year unless those wages are subject to Social Security. Under Payroll Data indicate 51440-00 as the Normal Work Account and also under the default account number for the Pay Rate.

Id put poll worker pay on Line 21 of 1040 and look to tick a box or not tick a box so that it isnt subject to SE tax. Election Officials and Election Workers. Firstly here is a link to determine if your election earnings are in fact tax exempt.

A great way to meet new people and learn how to deal with stressful situations and work through problems. Any compensation you receive as a poll worker is to be reported as taxable on your IRS Form 1040 US. Compensation paid to election workers is includible as wage income for income tax purposes and may be treated as wages for Social Security and Medicare FICA tax purposes.

Income tax withholding. New York A3484 2019-2020 Exempts poll workers from the obligation to pay New York state income tax on income earned on an election day. In addition they may be asked to attend a training session before the election.

Some counties also pay poll workers for attending training. Is that in order to be subject to SE tax the activity would need to be carried on more often than twice every other year or so. Enter in the personal information under the General and General cont tabs.

Gross Income Tax Election Worker Stipend. You are 16 years old or older. Gross Income Tax Election Worker Stipend.

54A5-1a gross income includes all wages salaries commissions tips bonuses sales awards and other types of compensation for services renderedTherefore for tax purposes the stipend that poll workers receive as compensation for their. If an election worker is paid 1800 or more FICA taxes apply from the first dollar paid. The November election is less than two months away 53 days to be exact and some are concerned the increase in pay for poll workers in Philadelphia is attracting elderly people who.

To become an election worker in Los Angeles County you must be. Do not deduct EI premiums from the election workers pay if both of the following conditions apply. Election workers paid less than 1800 in a calendar year beginning January 1 2017 and going forward are excluded from FICA taxes.

The 35 hours do not have to be consecutive but they must be in the same calendar year and they must be with the same employer.

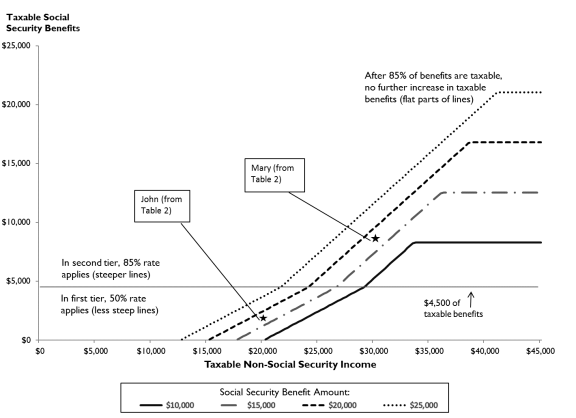

Ssdi Federal Income Tax Nosscr

Ssdi Federal Income Tax Nosscr

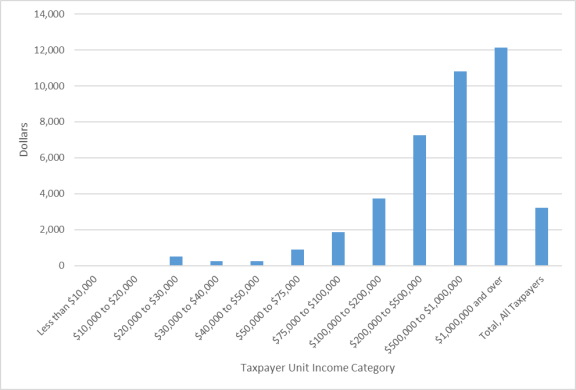

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Hundreds Of Election Workers Still Needed Pay Hike To 300 A Day Will Help County Officials Say Nj Com

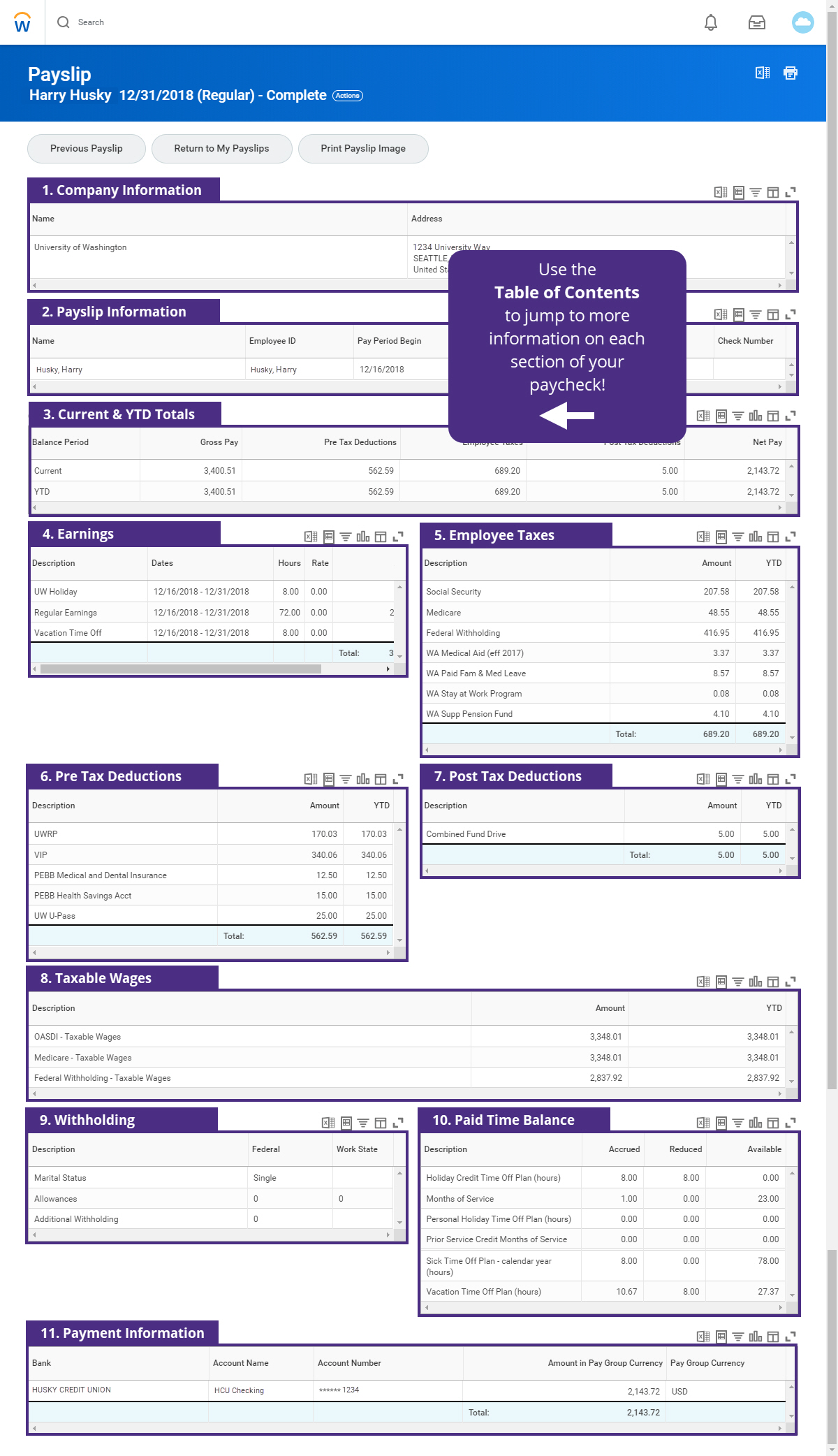

How To Read Your Payslip Integrated Service Center

Election Day Poll Workers Luzerne County Pa

Social Security Taxation Of Benefits Everycrsreport Com

Taxation Of Social Security Benefits Mn House Research

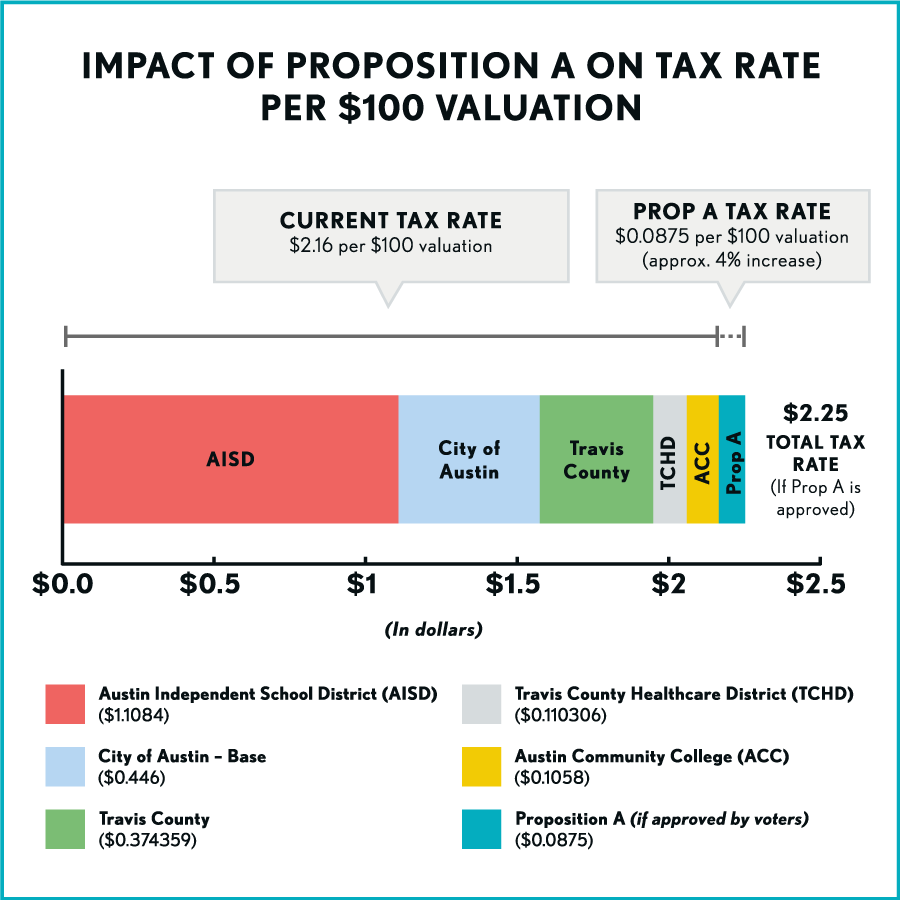

2020 Mobility Elections Proposition A Austintexas Gov

Social Security Taxation Of Benefits Everycrsreport Com

Workers Comp Exemption Workers Compensation Exemption

Understanding Your Form 1099 R Msrb Mass Gov

Taxation Of Social Security Benefits Mn House Research

Income Stocks With A Trump Tax Bonus

Biden Tax Plan And 2020 Year End Planning Opportunities

Qualifications Compensation Election Dates

Post a Comment for "Is Election Worker Pay Taxable"