How Often Do You Record Depreciation Expense

Click to see complete answer. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators.

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

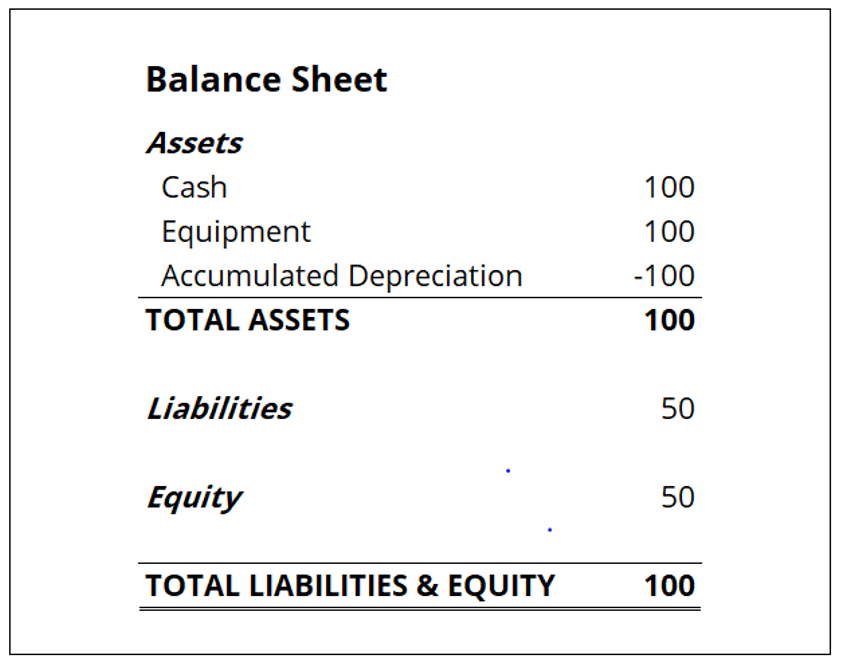

Why Is Accumulated Depreciation A Credit Balance

3430 x 30 percent 1029.

How often do you record depreciation expense. The annual depreciation expense is often added back to earnings before interest and taxes EBIT to calculate earnings before interest taxes. 10000 x 30 percent 3000. Some organizations do not like writing off a non-cash expense and in some cases an organization can have a tight budget so they decide to change their policies and not account for depreciation as it decreases the overall revenue but they might have to.

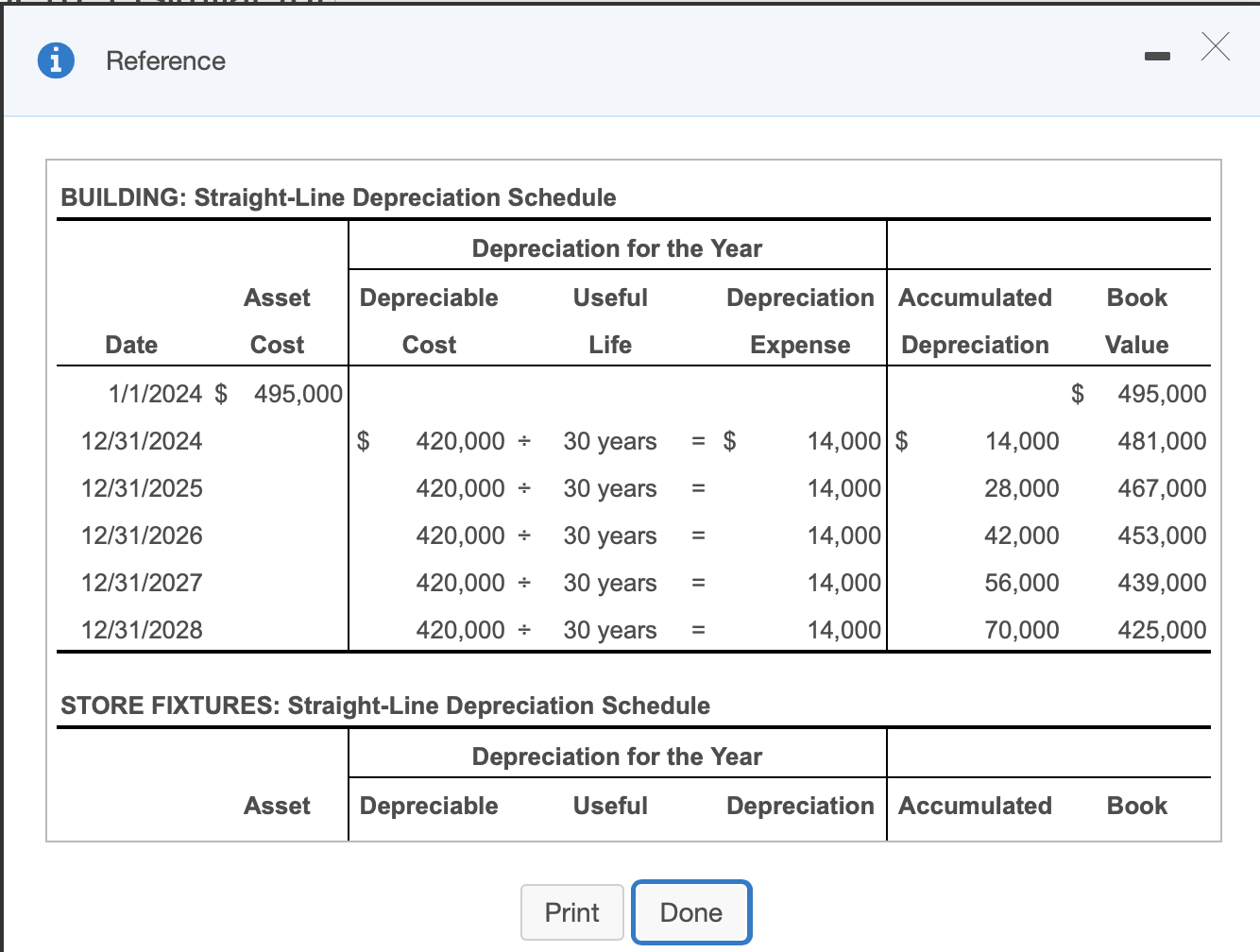

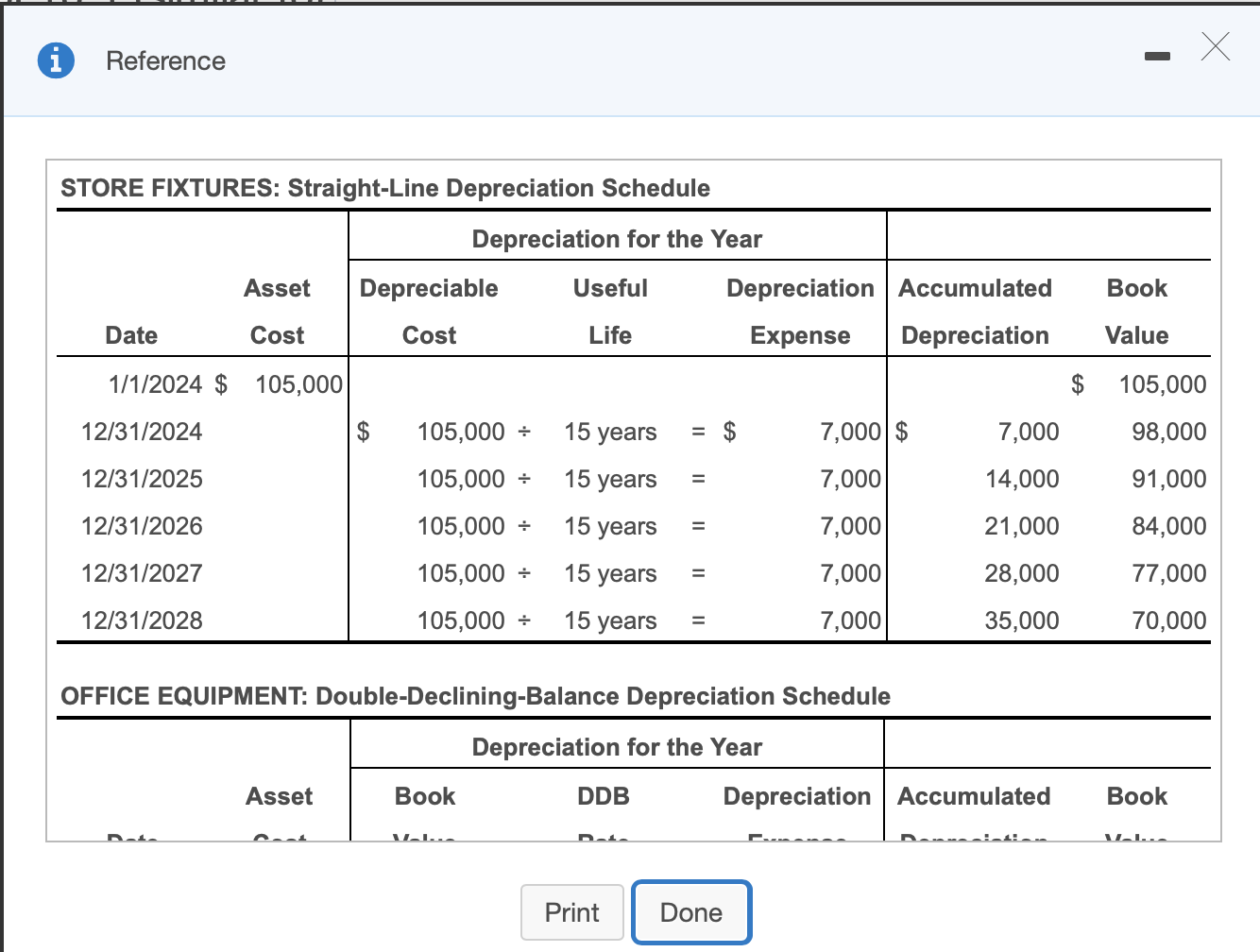

Heres what the depreciation schedule looks like based on the declining balance method. How do you record a journal entry for patentstrademarkcopyright amortization. Many companies automatically record depreciation for one-half year for any period of less than a full year.

Using the straight-line method distribute the cost equally over the equipments lifespan. Additionally is accumulated depreciation an asset or liability. In your last year of depreciation youll write off 173.

This yields your annual depreciation figure. If youre recording depreciation monthly youll do a second calculation. Understand the need to record depreciation for the current period prior to the disposal of property or equipment.

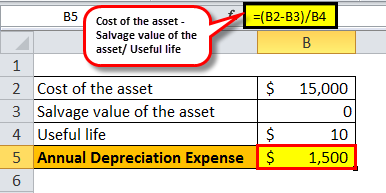

The equipment is not expected to have any salvage value at the end of its useful life. Depreciation is nothing more than a mechanical cost allocation process. Depreciation Cost Salvage Value Useful Life of Assets.

7000 x 30 percent 2 100. At that time stop recording any depreciation expense since the cost of the asset has now been reduced to zero. Keep in mind each year the bouncy castles remaining lifespan is reduced by one So in your second year of depreciation your equation will look like this.

It results in a larger amount of depreciation expense in the early years of an assets life relative to the straight-line method. Example of the Depreciation Entry. 955 x 10000 500 1555.

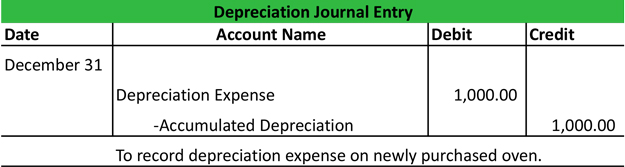

It is not an attempt to mirror current value. Expense 1000 in depreciation each year for five years 5000 5 years 1000 per year. Debit the depreciation expense account in a journal entry in your accounting records at the end of the year by the amount of the buildings annual depreciation.

Each year 22500 is added to the accumulated depreciation account. You decide to depreciate the expense over five years. Deduct your self-employed car expenses on.

Schedule F Form 1040 Profit or Loss From Farming if youre a farmer. If you know a buildings annual depreciation expense you can record it in your small businesss accounting records and on your financial statements. Also to know is how often do you record depreciation expense.

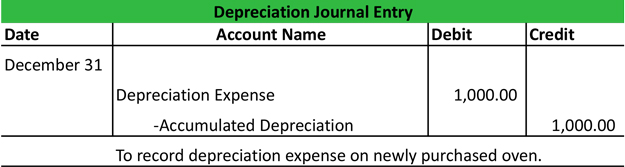

The initial value of the equipment is 5000. The accelerated methods result in a smaller amount of depreciation expense in the later years of an assets life. The company intends to follow the straight-line method of depreciation over the 3 years life.

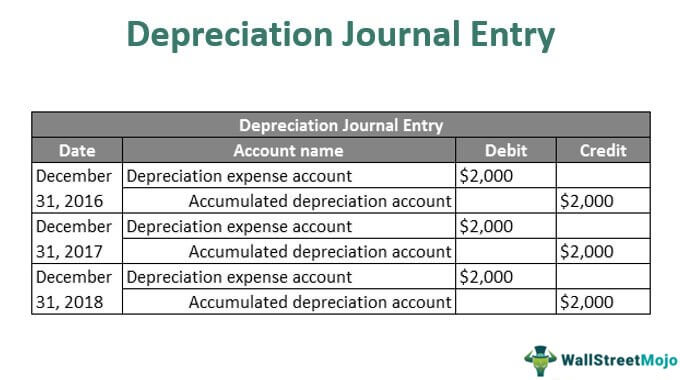

Reporting Depreciation Expense Varies in NPOs. ABC Company calculates that it should have 25000 of depreciation expense in the current month. The yearly depreciation expense using straight-line depreciation would be 22500 per year.

103 Recording Depreciation Expense for a Partial Year. 96667 12 8056. So for your first year youll write off 1727.

Year 5 works a little differently. If youre an Armed Forces reservist a qualified performing artist or a fee-basis state or local government official complete Form 2106 Employee Business Expenses to figure the deductions for your car expenses. 4900 x 30 percent 1470.

The equipment is estimated to have a useful life of 3 years. The formula is as follows.

Depreciation Journal Entry My Accounting Course

Depreciation Nonprofit Accounting Basics

Solved Need Help With Part 2 Please This Is A Chegg Com

Depreciation Journal Entry Step By Step Examples

Solved E Record Depreciation Expense For The Year Prepare Chegg Com

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Expense Depreciation Expense Accountingcoach

Fully Depreciated Assets Definition Examples How To Account

Fully Depreciated Asset Overview Calculation Examples

Explain And Apply Depreciation Methods To Allocate Capitalized Costs Principles Of Accounting Volume 1 Financial Accounting

Accumulated Depreciation Overview How It Works Example

3 Ways To Account For Accumulated Depreciation Wikihow

Depreciation Nonprofit Accounting Basics

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Depreciation Journal Entry Step By Step Examples

Depreciation Of Operating Assets

Solved E Record Depreciation Expense For The Year Prepare Chegg Com

Straight Line Depreciation Accountingcoach

Post a Comment for "How Often Do You Record Depreciation Expense"