Are World Bank Salaries Taxable

15 fifteen global practice units and 5 five global themes units. The set of salary ranges established for various grade levels.

Benefits Of Registering A Company Name Business Bank Account Company Names Small Business Loans

Reported on Schedule SE and attached to Form 1040.

Are world bank salaries taxable. In our comparison over 63 countries the USA comes 2th with an average income of 65910 USD. Each grade has a minimum and a maximum called a salary range and a midpoint. Therefore each American is responsible for payment of quarterly estimated taxes to state and federal authorities.

World Bank income for greencard holders is nontaxable. June 3 2019 617 PM. For international staff positions salary is set with reference to the global market for equivalent jobs.

Each grade has a minimum and a maximum called salary ranges and a midpoint. The average The World Bank salary ranges from approximately 115631 per year for a Short-term Consultant to 470348 per year for a DirectorThe average The World Bank hourly pay ranges from approximately 54 per hour for a Short-term Consultant to 66 per hour for a ConsultantThe World Bank employees rate the overall compensation and benefits package 45 stars. Tax law Americans who work for the Bank are paid a tax supplement in addition to their base salary so that they dont come out effectively making 40 less than their colleagues from other countries who are not liable for income taxes.

Because World Bank salaries and pension are paid on net-of-tax basis due to the fact that its an international organization not subject to US. According to the World Bankthe highest employee at the institution pockets 424000 per year which is equivalent to Ksh 424 million. I World Banks participating units.

The worldwide highest income is earned in Isle of Man. Since July 2014 the Bank has had a new organizational model which is structured as follows. For American citizens the WBG awards an additional payment to cover federal state and location income tax liabilities on their World Bank Group income.

The average income is calculated by gross national income and population. For Staff Members who are not US citizens since they are employed by an international organization they are not liable for tax payments in the country. The most senior high-level policy makers at the bank are paid upward of 200000 and a few edge up over 300000.

At the World Bank Group the salary structure or salary scale has 11 salary ranges from GA to GK. 58 reviews from World Bank employees about World Bank culture salaries benefits work-life balance management job security and more. The World Bank is a first class institution where you will learn a lot work with people from around the world.

One thing to note is that World Bank employees in most countries dont pay taxthe amount they. 6 six regional units focusing on clients with offices in the majority of the borrowing countries. Average income around the world.

Management can be difficult and the can play favorites when it comes to promotions. Government workers and almost all Americans in the private sector World Bank employees salaries are largely tax-free which makes their disposable income dramatically larger. It is denominated in US dollars and is not subject to taxation by many ADB member countries.

The young professionals are assigned to the World Bank Groups technical and operations units. World Bank salaries are net of taxes so US citizens working for the World Bank within the US receive a supplement to cover their tax obligation to the US government. Foreign nationals who work for the World Bank and other international organizations do not have to pay US taxes.

Why after entering the amount in other reportable income as per Turbotax guidelines the Federal Refund goes down. For general questions regarding taxes contact the Tax Service Desk. Income IS taxable to Resident Aliens greencard holders but not subject to.

The benefits are stellar but be ready to work a lot. This amount is net pay. Citizen colleagues who do not pay income.

The structure adjustment aligns the salary scales with the increases in labor market salary levels. The smallest budget per capita exists in Burundi. On dividing all annual incomes and.

US Treasury Secretary Yellen will use the platform to push for a global standardization. Some ADB member countries have retained the right to tax the ADB salary and. This is because they are here officially representing foreign governments in a diplomatic role.

Citizen staffwho owe taxes on their Bank income are treated similarly in salary matters as their nonUS. The World Bank doesnt withhold taxes from payroll employees. The only World Bank employees who are exempt from Federal Income taxes are those who live and work here but are NOT United States citizens.

The World Bank Group Tax Allowance System 5 Tax Allowance System The Bank has set up the tax allowance system so US. The IMF and World Bank spring meetings are about to kick off where those who pay no income tax get to talk about tax evasion tax hikes inequality and Building Back Better. World Bank employees who are US Citizens and work in the US most absolutely do pay US income taxes.

World Bank Group the salary structure or salary scale has 11 salary ranges from GA to GK. The Bank Group does not withhold taxes from salary payments. Any opportunity coming up will we want to work for the Bank again.

In some country offices the scale starts with G1 grade. World Bank was an excellent organization providing enriching exposure attractive salary and a wonderful work life balance all at at the same time.

How Much Money Do The Top Income Earners Make By Percentage

Exploring Universal Basic Income By World Bank Group Publications Issuu

Taxes And Student Loan Forgiveness Student Loan Forgiveness Loan Forgiveness Student Loans

Saas And Tech Ceo Salary Data In 2021 Term Sheet Fintech Dataset

Income Tax Definition Calculator Investinganswers

Why New York Is In Trouble 290 304 Public Employees With 100 000 Paychecks Cost Taxpayers 38 Billion

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

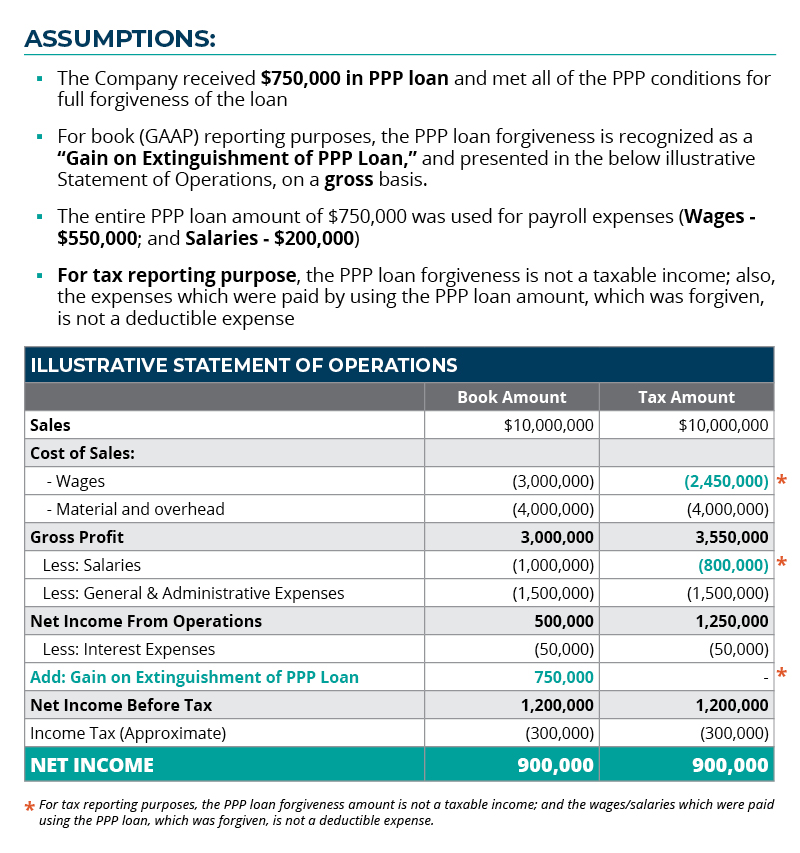

Ppp Reporting Period Net Income Management Tax Considerations For Manufacturers Sikich Llp

Here S How Much Money You Take Home From A 75 000 Salary

Accounting Relationship Linking The Income Statement And Balance Sheet Money Instructor Accounting And Finance Profit And Loss Statement Good Essay

Small Business Income Statement Template Beautiful 7 Free In E Statement Templates Excel Pdf Form Statement Template Profit And Loss Statement Income Statement

World Bank Salary Grades Jobs Ecityworks

Post a Comment for "Are World Bank Salaries Taxable"