Can You Carryback Nol In 2018

Even better the tax rates during those years were higher than they are currently which for many is. 199A Deduction for Qualified Business Income page 44 the laws changes to the net-operating-loss NOL carrybackcarry.

What Are Good Ways To Use Your Tax Refund Tax Refund Tax Money Personal Loans

May 1 2018.

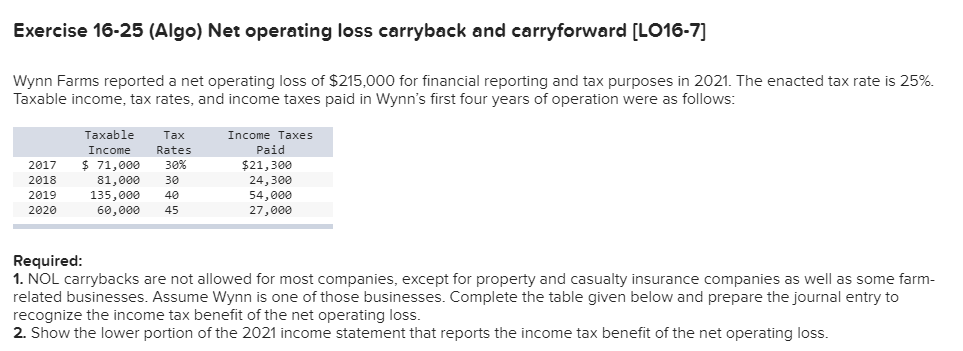

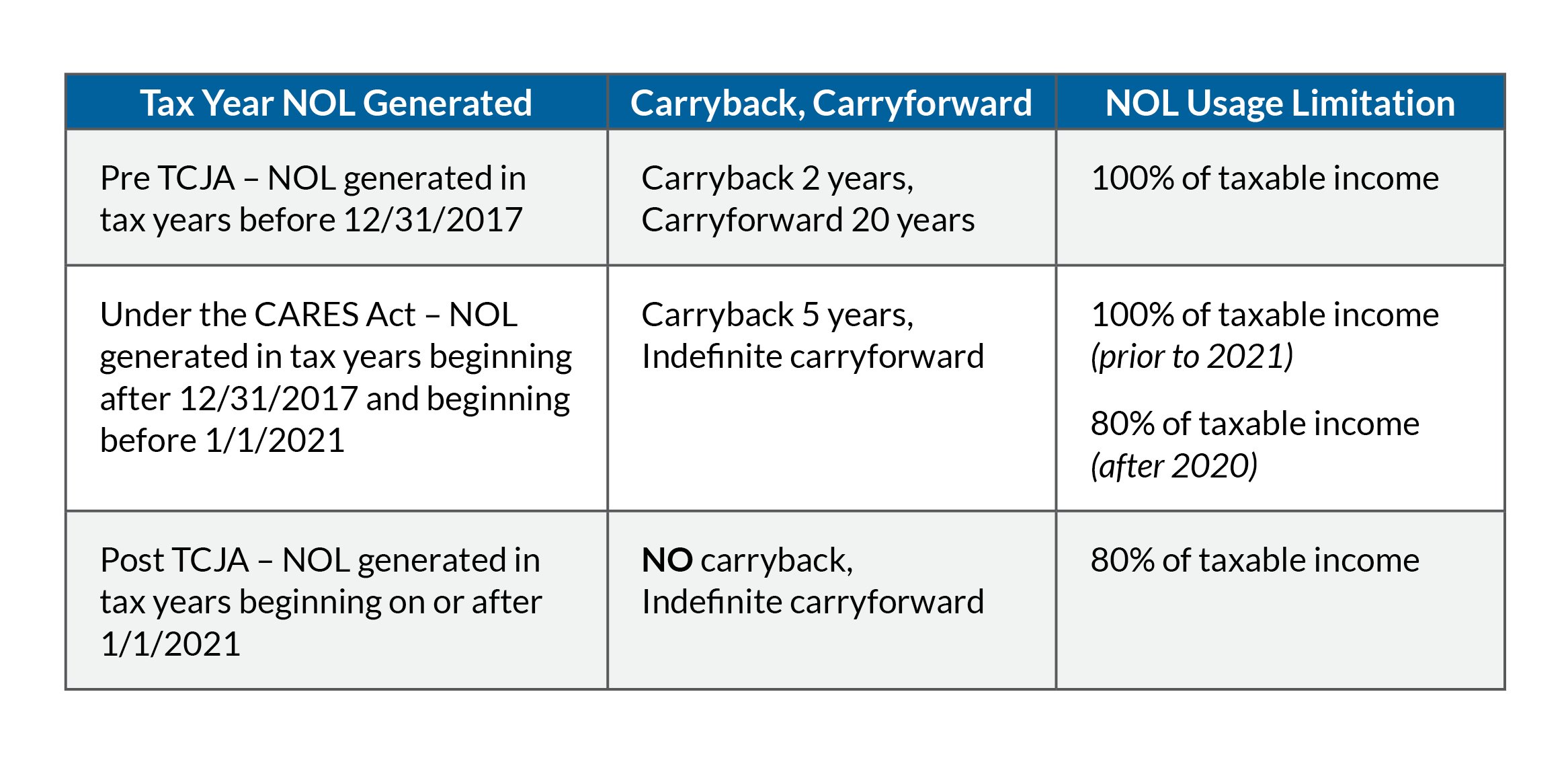

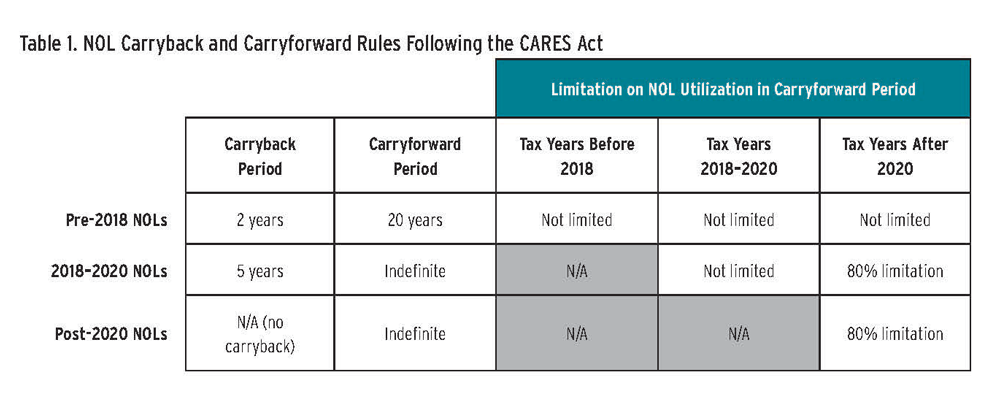

Can you carryback nol in 2018. The 2-year carryback rule in effect before 2018 generally does not apply to NOLs arising in tax years ending after December 31 2017. Up to 10 cash back Taxpayers may now use a five-year carryback for net operating losses NOLs arising in tax years beginning in 2018 2019 and 2020 compliments of the Coronavirus Aid Relief and Economic Security CARES Act PL. A taxpayer entitled to a carryback period can make an irrevocable election to relinquish the carryback period for an NOL for any tax year.

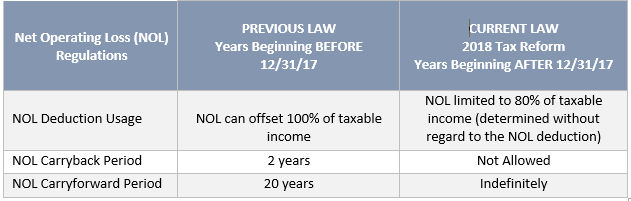

For tax years beginning before January 1 2018 NOLs were able to offset 100 of taxable income. You may be able to claim your loss as an NOL deduction. An election to waive the carryback for NOLs arising in tax years beginning in 2018 or 2019 must be made no later than the due date including extensions for filing the taxpayers federal income tax return for the first tax year ending after March 27 2020.

With the CARES act modification I should be able to go back to 2014 but when I enter 2019 on the Year of Loss line on 2014 input sheet 15 I receive a Data Entry Error saying Value must be between 1993 and 2018not allowing 2019. Section 2303 of the Coronavirus Aid Relief and Economic Security Act CARES Act revised the provisions of the Tax Cuts and Jobs Act TCJA section 13302 for tax years 2018 2019 and 2020. You can waive your right to carry a NOL back but then you have to carry the entire loss forward.

5 year NOL carryback. Generally the NOL will be carried back to the earliest possible tax yearand if it is not used up. Under the new law an NOL can offset only 80 of taxable income in any given tax year.

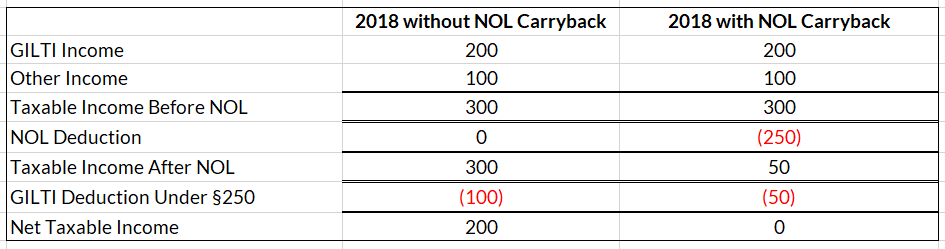

Filers may be able to carry back these losses for five years on their federal return. 6411 to carry back an NOL that. The new five-year NOL carryback rule may create some complexities for corporations because of the interplay with the AMT.

The IRS provided guidance on how taxpayers who want to elect to waive or reduce the new provision requiring taxpayers with net operating losses NOLs arising in tax years beginning in 2018 2019 and 2020 to carry them back five years Rev. If your deductions and losses are greater than your income from all sources in a tax year you may have a net operating loss NOL. However you may file an election to either waive the entire five-year carryback period or to exclude all of your section 965 years from the carryback period.

The election to waive the NOL carryback for NOLs arising in tax years beginning in 2018 or 2019 must be made no later than the due date including extensions for filing the taxpayers federal income tax return for the first tax year ending after March 27 2020. However in Notice 2020-26 the IRS granted a six-month extension to June 30 2020 to file a 2018 tentative carryback adjustment under Internal Revenue Code IRC Section 6411. For federal tax purposes the Coronavirus Aid Relief and Economic Security CARES Act allows filers to carryback losses earned in 2018 2019 or 2020.

To waive a carryback claim for a 2018 or 2019 NOL a taxpayer must attach an election to forego the carryback to its federal income tax return filed for its first tax year ending after March 27. Exceptions apply to certain farming losses and NOLs of insurance companies. Generally you are required to carry back any NOL arising in a taxable year beginning in 2018 2019 or 2020 to each of the five taxable years preceding the taxable year in which the loss arises.

For NOLs incurred in taxable years beginning in 2019 you may carry the NOL back two years and then forward for up to 20 years. The CARES Act provided for a special 5-year carryback for taxable years beginning in 2018 2019 and 2020. The CARES Act restores a taxpayers ability to file an NOL carryback up to five years for tax years 2018 through 2020 which means if an individual or a corporation has a loss during these years that loss can be carried back to 2013 2015.

CTL conform to federal law by allowing a five year carryback of an NOL incurred in a taxable year that begins on or after January 1 2018 and before January 1 2021 and allow an election to file a short period return for the first six months of a taxable. Furthermore for 2018 2019 and 2020 corporate taxpayers can use NOLs to fully offset their taxable income rather than only 80 of taxable income. In response new IRS guidance.

Or you may elect to waive the carryback. Because the NOLs from 2018 2019 and 2020 stand on their own you have to decide if you want to carry back each years loss or apply the NOL to future tax. Furthermore NOLs can no longer be carried back they must be carried forward.

They were allowed to be carried back two years and carried forward for twenty years. For most taxpayers NOLs arising in tax years ending after 2020 can only be carried forward. Purpose of 2018 Form X-NOL.

Im filing my first NOL carryback for a 2019 loss. Can the corporation also carry back alternative tax NOLs. Minnesota does not recognize the CARES Act provisions on NOLs.

2018 Carryback of Net Operating Loss NOL Instructions. 115-97 known as the Tax Cuts and Jobs Act TCJA cut the top corporate income tax rate from 35 to 21 and provided a 20 deduction for qualified passthrough and sole proprietor-ship business income see Mechanics of the New Sec. CARES also allows businesses to carry back losses for 2018 2019 and 2020 for five years.

The IRS also extended the deadline for filing an application for a tentative carryback adjustment under Sec. Taxpayers can carry back NOLs including non-farm NOLs arising from tax years beginning in 2018 2019 and 2020 for 5 years. This deduction can be carried back to the past 2 years andor you can carry it forward to future tax years.

In particular the CARES Act left unclear what happens when a corporation carries back NOLs to tax years when the AMT was still in effect prior to 2018. Extends the deadline for filing tentative refund claims for NOLs arising in 2018 tax years. Tax year 2018 NOLs normally could not be carried back using the short-form application for tentative refund because the due date of the form was December 31 2019.

Cares Act International Tax Implications Of Nol Rule Changes Rkl Llp

Revised Montana Nol Schedule For Tax Years 2018 2020 Montana Department Of Revenue

Solved Nol Carryforward Worksheet Or Statement

Cares Act International Tax Implications Of Nol Rule Changes Rkl Llp

Cares Act Five Year Nol Carryback Rules Will Have Significant Impact On M A Transactions Lexology

Nol Carrybacks Under The Cares Act Tax Executive

Solved Waive Carryback Period Under Section 172 B 3

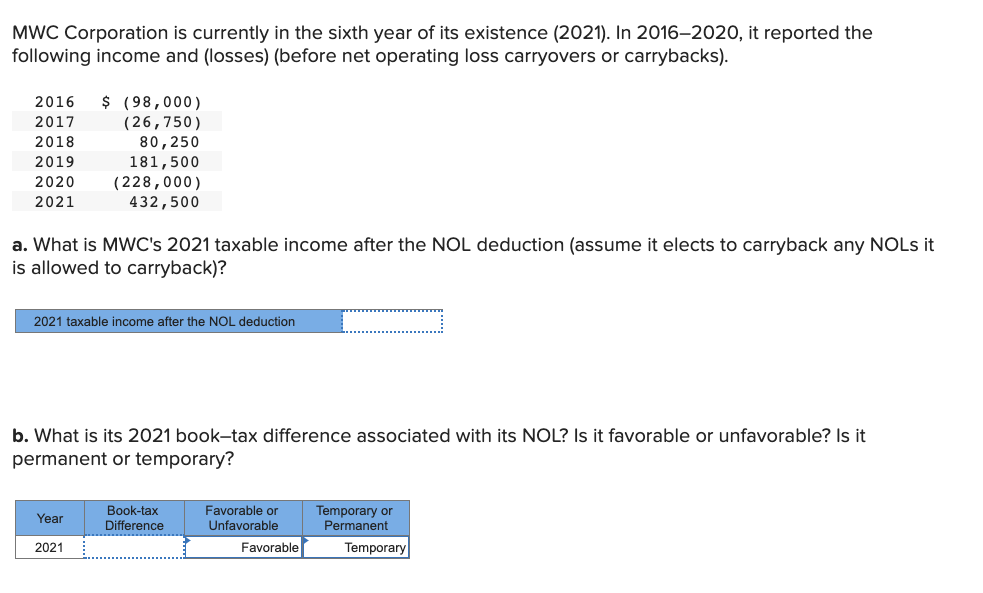

Solved Mwc Corporation Is Currently In The Sixth Year Of Its Chegg Com

Irs Issues 2016 Version Of Publication 463 On Travel Entertainment Gift And Car Expenses In 2021 Learning Technology Tax Irs Taxes

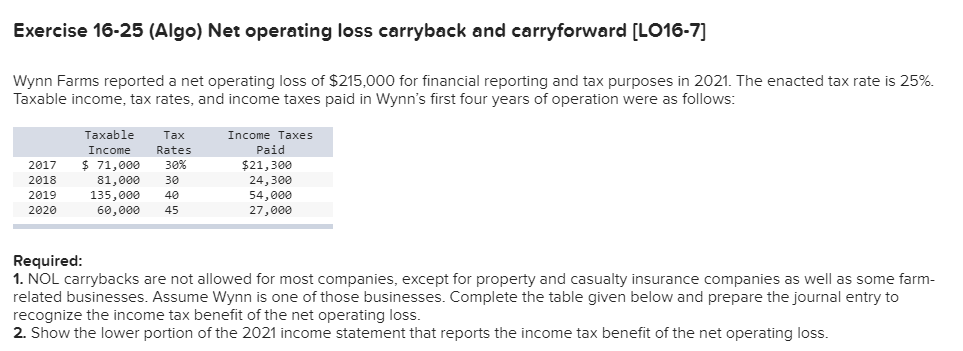

Solved Exercise 16 25 Algo Net Operating Loss Carryback Chegg Com

Net Operating Losses Under The Tax Cuts And Jobs Act Bkd Llp

How Net Operating Losses Are Impacted By The Cares Act Mfa Insights

Carry Your Losses Further Forward Journal Of Accountancy

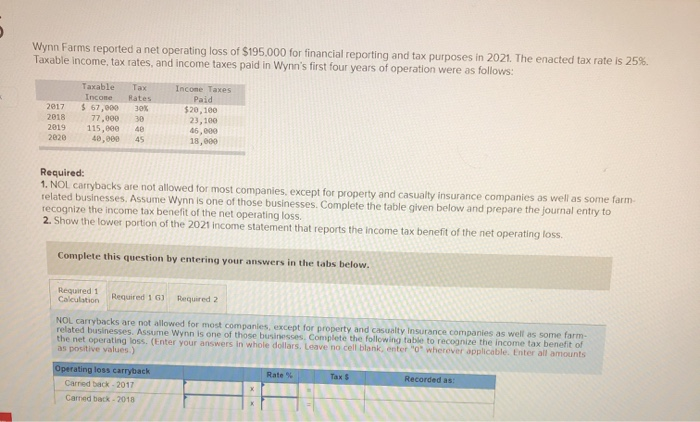

Solved Wynn Farms Reported A Net Operating Loss Of 195 000 Chegg Com

Post a Comment for "Can You Carryback Nol In 2018"