When Can You Not Make A 754 Election

Can you make a late. It must be made before the due date of the income tax return including extensions for the year that the transfer occurs.

Section 754 And Basis Adjustments Pdf Free Download

El ti i fil d ith ti l fil d t hi t i l di Election is filed with a timely filed partnership return including extensions.

When can you not make a 754 election. The basis of the assets of a partnership or LLC may not reflect the basis of the interest in the hands of the partnerss. A taxpayer will be deemed to have acted reasonably and in good faith with respect to the requested extension if the taxpayer 1 requests relief before the IRS discovers the failure to make the election. October 13 2017 by Ed Zollars CPA.

At this time ATX does not support the automatic calculation of Section 754 elections. A sells his interest in the partnership to D on January 1 1971. 2 failed to make the election because of intervening events beyond the taxpayers control.

To enter Section 754 elections do the following. The partnership and the partners use the calendar year as the taxable year. The purpose of a Section 754 election is to reconcile a new partners outside and inside basis in the partnership.

47408-47409 October 12 2017. People also ask when should you make a 754 election. Two statements should be attached to the return for the taxable year during which the distribution or transfer occurs.

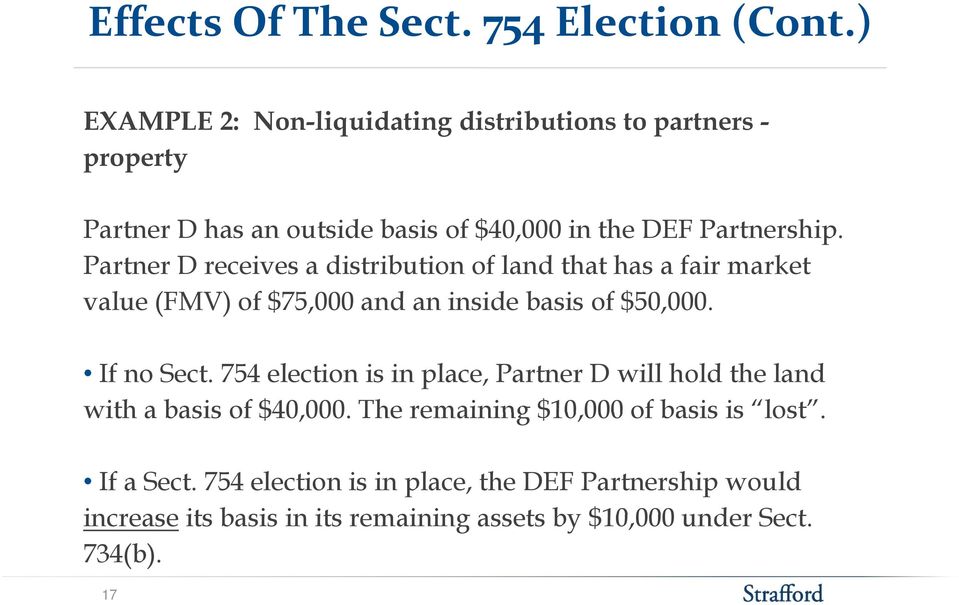

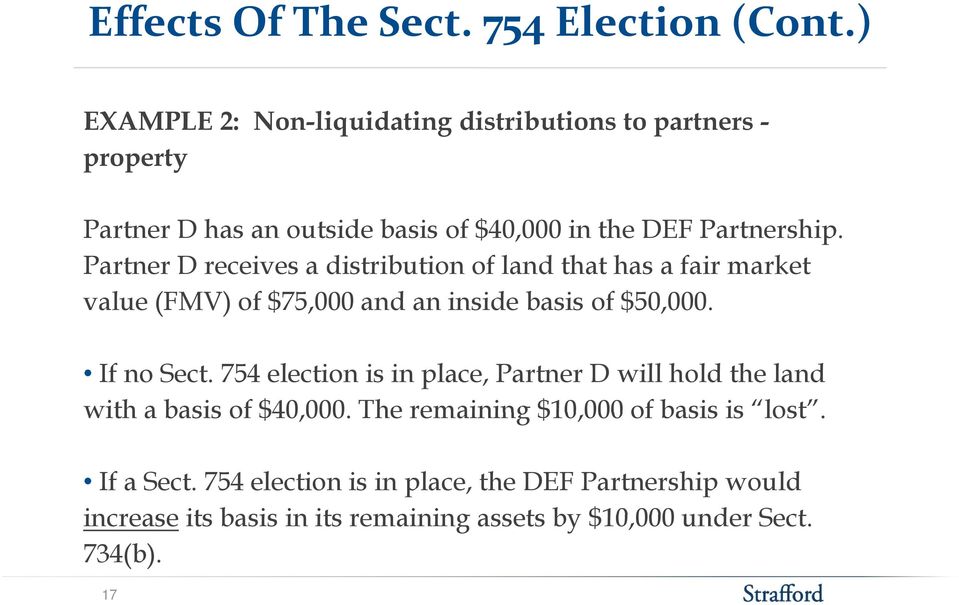

The challenges of the 754 election add consideration to the overall benefits of making this potentially advantageous election. 1 2017 Partner D will not recover his outside basis or 100 purchase price in excess of inside basis until the year of liquidation. Section 743 Transfer of an interest in a partnership by sale or exchange or on death of a partner.

754 El iElection Partnership may make the Sect. 754 election is filed for a year in which a triggering distribution or transfer occurs however the election continues indefinitely until permission is sought and granted to revoke the election or until the partnership undergoes a technical termination Sec. 1754-1 In order to make a valid election the return must be timely filed.

When the 2017 return was due the appraisals for all the properties were not completed. 754 election must 1 set forth the name and address of the partnership making the election 2 be signed by any one of the partners and 3 contain a declaration that the partnership elects under Sec. Five partners contributed 100000 each to.

The Section 754 election must be made before the due date of the income tax return including extensions for the year in which the transfer occurs IRC Sec. Signature No Longer Required When Making IRC 754 Election. The partnership includes other partnerships that own shopping centers.

754 election at any time does not require the occurrence of a triggering event. Select the Ln 13d Sch K - Oth Ded tab. Similarly do you have to make a 754 election every year.

754 election be made in a written statement filed with the partnerships tax return. This balances the inside cost basis and outside cost basis and reduces capital gains tax when a property that has appreciated is sold. Go to Form 1065.

Citizen is a member of partnership ABC which has not previously made an election under section 754 to adjust the basis of partnership property. If a Section 754 election is made by the entity certain events can trigger an equalization of basis without waiting until the assets are sold. Go to Page 3.

Once a valid Sec. The Section 754 election must be made before the due date of the income tax return including extensions for the year in which the transfer occurs IRC Sec. Election must be signed by a partner.

This election allows the new partner to receive the benefits of depreciation or amortization that he or she may not have received if the election was not. 1754-1b For partnerships this is on or before the fifteenth day of the fourth month following the close of the partnerships taxable year. Under the Section 754 regulations however an application to revoke the election will not be approved if the revocations primary purpose is to avoid stepping down the basis of partnership assets.

If the partnership has elected 754 and has not properly revoked that election there is no reason to elect again. Section 754- Making the Election For a Section 754 Election to be valid a written statement must be attached to the partnership return and filed no later than the return due date including extensions. Further a valid Sec.

If the partnership decides they want the step-up they must make the 754 election. 3 failed to make the election because after exercising reasonable diligence taking into account the taxpayers. Under proposed regulations on which taxpayers may rely upon immediately elections made by partnerships under IRC 754 will no longer have to be signed by a partnership representative REG-116256-17.

MkiMaking The Sect. Besides when can you make a section 754 election. When a 754 election is made the partnership steps up the inside cost basis but only for the new partner.

Utilizing this election can. Applying a 754 Election. The Section 754 election must be made before the due date of the income tax return including extensions for the year in which the transfer occurs.

Currently IRS regulations require the Sec. Go to Form Sch K-1 1065. Situations Where a Basis Adjustment Can Be Made.

Consider the following scenario. I know we have an automatic 12 month extension from the due date to file the amended return and make the 754 election. There are two Sections in Subchapter K that allow for basis adjustment if a Section 754 election is in place when the inside and outside basis differ.

754 to apply the provisions of Secs. Under section 754 a partnership may elect to adjust the basis of partnership property when property is distributed or when a partnership interest is transferred. The purpose of a Section 754 election is to reconcile a new partners outside and inside basis in the partnership.

Making the Election. Select the Yes check box on Line 12a - Is the partnership making or had it previously made and not revoked a section 754 election. For Byron Brown the Masten District is home turf having represented its neighborhoods on the Common Council before becoming mayor in 2006 and still maintaining a.

We need to amend a Form 1065 to include a Sec. A Section 754 election applies to all property distributions and transfers of partnership interests during the partnership tax year for which the election is made plus for all later tax years unless revoked. If Donut breaks even in years 2006 through 2016 and disposes of the property without a Section 754 election on Jan.

Consequences Of A Section 754 Election

Chapter 13 Basis Adjustments To Partnership Property Ppt Download

754 And Basis Adjustments For And Llc Interests

Making A Valid Sec 754 Election Following A Transfer Of A Partnership Interest

Consequences Of A Section 754 Election

Advantages Of An Optional Partnership Basis Adjustment

Section 754 Elections Theory Practice Youtube

Chapter 13 Basis Adjustments To Partnership Property Basis

Advantages Of An Optional Partnership Basis Adjustment

Partnership Taxation What You Should Know About Section 754 Elections

Chapter 13 Basis Adjustments To Partnership Property Basis

Section 754 And Basis Adjustments Pdf Free Download

Chapter 13 Basis Adjustments To Partnership Property Ppt Download

Section 754 And Basis Adjustments Pdf Free Download

An Alternate Route To An Ipo Up C Partnership Tax Considerations Part 2

Section 754 And Basis Adjustments Pdf Free Download

Avoid Costly Tax Issues By Considering The Section 754 Election Businesswest

Section 754 And Basis Adjustments Pdf Free Download

Partnership Taxation What You Should Know About Section 754 Elections

Post a Comment for "When Can You Not Make A 754 Election"