How To Use Up Dependent Care Fsa

As we saw in the previous example you can use your contributions to pay for a babysitter nanny and preschool. A Dependent Care FSA is an employer-offered pre-tax savings account that can be used to cover qualified out-of-pocket dependent care expenses.

Worried About Using Up Your Childcare Fsa Funds Bri Benefit Resource

ARPA allows employers to increase the annual limit on contributions to dependent care FSAs up to 10500 for the 2021 plan year only.

How to use up dependent care fsa. Choose Pay My Provider. Youll do this on IRS Form 2441. If youre married your spouse can put up to 2750 in an FSA with their employer too.

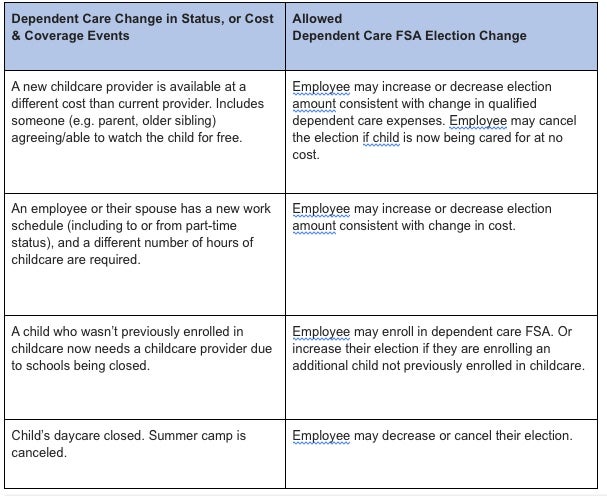

In your case the FSA saves you 25 federal tax plus 3-10 state tax depending on the state on the first 5000 of expenses and the dependent care credit will pay 20 of 1000 more. Enter the required payment details and select Submit Claim. The dependent care FSAs third-party administrator will require the employee to certify that the expenses are eligible for reimbursement upon submitting a claim.

With dependent care FSAs you pay expenses out-of-pocket then receive reimbursement based on how much you have withheld from your paycheck for dependent care expenses. The contributions you make not only escape federal and state taxes but also payroll taxes commonly. On March 11 2021 The American Rescue Plan Act of 2021 ARPA was signed into law by President Biden.

Select Deduction and Select Next. Where in question employees should consult a personal tax advisor for assistance in determining whether their expenses are eligible for dependent care FSA reimbursement. Your employer will also list your contributions on your Form W-2.

Select the account that should pay your provider. Set the Tax Tracking Type to either Dependent Care FSA or Med Care Flex Spend and select Next. You can use funds in your FSA to pay for certain medical and dental expenses for you your spouse if youre married and your dependents.

Set up one-time or recurring monthly payment. While using the dependent care credit only without the FSA would save you 20 up to the first 6000. HSFAs can be used for medical expenses not covered by health insurance and DCRAs can be used for childcare expenses for dependent children up to the age of 13.

What You Can Use Your DCFSA Contributions For. Child and Dependent Care Expenses. This way youll likely use all the funds for dependent care expenses and not leave money on the table.

Look up eligible expenses. This type of plan is a voluntary agreement to reduce your salary in return for an employer-provided fringe benefit. For more information see instructions for IRS Form 2441 at wwwirsgov.

You decide on the amount of money you want to contribute to the account each pay period. How to get a Dependent Care FSA. Select Submit Receipt or Claim.

Arrange for us to send payments directly to your health care or dependent care provider. Those funds are then automatically withheld from your paycheck and deposited before taxes are deducted. Youre receiving a tax benefit because under the plan youre not paying taxes on the money set aside to pay for the dependent care.

Select your reimbursement methods by check or direct deposit Choose to. Enter the item name and select Next. Dependent-care FSAs reduce an employees gross income by putting money into a special account to cover annual care expenses for children or.

How a Dependent Care FSA Works. Dependent care FSAs are set up through your employer. When your FSA has built up enough funds you may submit receipts for your care expenses to the FSA administrator.

You can spend FSA funds to pay deductibles and copayments but not for. Here are a few more examples of what you can use your DCFSA contributions to pay for. Select on the Payroll Item button and select New.

Submit claims and view claims status. Dependent care FSA increase to 10500 annual limit for 2021. To pay a provider.

You must complete and attach Form 2441 Child and Dependent Care Expenses to your tax return. Dependent Care Flexible Spending Accounts FSAs also known as Dependent Care Assistance Programs DCAP allow you to use pre-tax dollars to pay for qualified dependent day care expenses to enable you to work. But there are an estimated 52 million dependent care accounts according to the financial research firm Aite Group and many of their holders have lost at least some income or have spouses who have.

Just like a health care FSA your dependent care FSA contributions come out of your paychecks throughout the year and go into your account. Your employer may also contribute to your DCFSA. LPFSAs are accounts that can be paired with a health savings account HSA to cover non-medical expenses such as vision and dental.

When you have a dependent care FSA you must include this information as part of your tax return. Select Custom Setup and select Next. Select the Liability Accoun t and Expense Account then Next.

Unfortunately the only way to obtain a Dependent Care FSA is if your employer offers the benefit Sweetham said. Simply log in to your FSAFEDS online account at any time to manage all aspects of your Dependent Care FSA. Since FSA contributions are pre-tax you save money by.

They will reimburse you the funds by check or direct deposit which may take a few weeks. Log in to your online account.

Coh Dependent Care Reimbursement Plan

How To File A Dependent Care Fsa Claim 24hourflex

1 Dependent Care Fsa Flexible Spending Account Presenter

Health Care And Dependent Care Fsas Infographic Optum Financial

Dependent Care Fsa Flexible Spending Account Ppt Download

Getting The Most Out Of Your Child Care Fsa Quality For Kids

Flexible Spending Account Nuesynergy

Coronavirus And Dependent Care Fsa H R Block

Dependent Care Fsa We All Spend Time On Finding Ways To Make Money And Invest But Finding Ways To Keep Wh After School Care Way To Make Money Personal Finance

How A Dependent Care Fsa Can Enhance Your Benefits Package

How To Use A Dependent Care Fsa When Paying A Nanny

Flexible Spending Accounts Fsa 2020

Dependent Care Assistance Program Optum Financial

What Is A Dependent Care Fsa How Does It Work Ask Gusto

Connectyourcare Why Employers Should Offer A Dependent Care Fsa

Dependent Care Flexible Spending Account

Message For 2020 Dependent Care Fsa Participants Office Of Faculty Staff Benefits Georgetown University

American Rescue Plan Act Increases Dependent Care Fsa Contributions Krs Cpas

Post a Comment for "How To Use Up Dependent Care Fsa"