How To Report Depreciation Recapture On Tax Return

In our above example if depreciation is deducted over the entire course of the propertys useful life the amount you would pay in depreciation recapture would be 275 X. Add-On Taxes and Recapture of Tax Credits.

NBAAs Virtual Aviation Tax Transactions Review launched Oct.

How to report depreciation recapture on tax return. Located in Minnesota Have a business presence in Minnesota Have Minnesota gross income. Complete sign and mail in the forms to the address on the form. Interest computed under the look-back method for completed long-term contracts Attach form FTB 3834 2.

A 1031 exchange can help you defer capital gains and depreciation recapture taxes. Interest on tax attributable to installment. The 30000 profit would be taxable as a capital gain which is taxable at favorable rates and the 15000 depreciation deduction would be considered taxable income taxable at your marginal tax rate.

Since the size of the depreciation recaptured increases with time you may be motivated to engage in a 1031 exchange to avoid the large increase in taxable income that depreciation recapture would cause later on. Since the depreciation recapture tax rate is 20 the amount to be taxed will be 3000 15000 20. We replaced the entire roof with all new materials replaced all the gutters replaced all the windows and doors and replaced the furnace.

Schedule J Add-On Taxes and Recapture of Tax Credits. Every sweet feature you might think of is already included in the price so there will be no unpleasant surprises at the. Sign Your Tax Return.

Do you owe 2016 Taxes to the IRS. Regular Method - NoAll allowed or allowable depreciation must be considered at the time of sale. In this situation the UCC is also 6000 10000 - 4000.

Chat with your writer and come to an agreement about the most suitable price for you. He subtracts 8000 the lesser of the proceeds of disposition of the property minus the related outlays and expenses. Include your phone number and email address in case the FTB needs to contact you for information needed to process your tax return.

Minnesota Individual Income Tax Mail Station 0010 600 N. If you want to hold off on paying this depreciation recapture tax you may want to. Note that if 15000 is greater than the total amount of depreciation deductions claimed by the owner the depreciation recapture will equal the amount of depreciation deductions and will be.

The form 3115 will determine a 481a adjustment that will provide a catch-up on any missed depreciation. This item addresses how S corporations and partnerships that have a Sec. Back Tax Forms and Calculators.

See previous IRS or federal tax year back tax forms. You must include a copy of your federal income tax return including schedules and any income tax returns you filed with other states. You can generally figure depreciation on the business use portion of your home up to the gross income limitation over a 39-year recovery period and using the mid-month convention.

Attachment to Report of Estimated Tax for Corporate Partners - Payments due April 15 June 15 September 15 2015 and January 15 2016 CT-2658-E Fill-in 1013 Instructions on form. If you may become liable for depreciation recapture tax upon disposition of your commercial property you should contact your tax advisor prior to the sale to limit your exposure to recapture tax. The depreciation recapture tax is typically 20 percent plus the state income tax on the depreciation amount that you claimed.

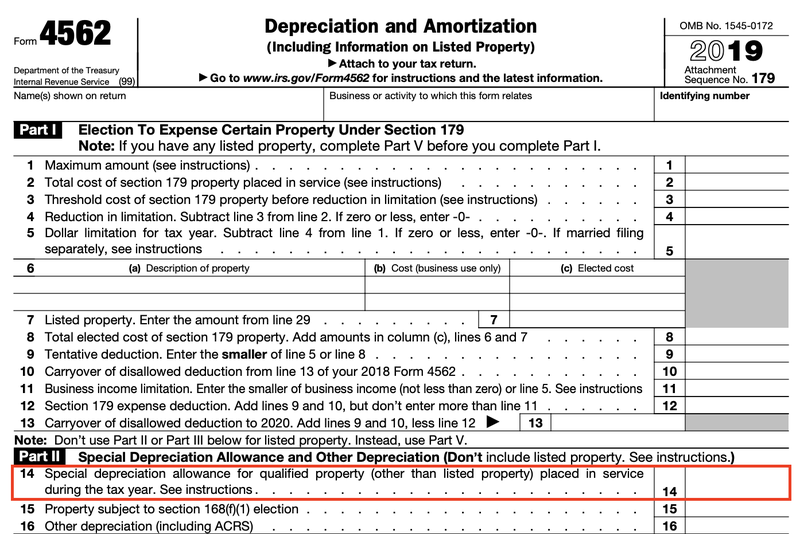

Depreciation and Amortization is an Internal Revenue Service IRS tax form used to depreciate or amortize property purchased for use in a business. Select one or more states and download the associated back tax year forms. We have incurred costs for substantial work on our residential rental property.

Individual Income Tax Return. 179 recapture information should report the recapture on Form 1040 US. Start with the back tax future calculators and tools to estimate your back taxes and future returns.

The depreciation recapture tax rate is 25 and is applied to the total amount of the depreciation deductions youve made. However the exact amount depends on your income tax bracket. Form 6252 must also be filed if the.

Attachment to Report of Estimated Tax for Corporate Partners - Payments due April 18 June 15 September 15 2017 and January 16 2018 CT-2658-E Fill-in 1217 Instructions on form. Head over to our 1031 exchange homepage for more information. A regulation relating to IRA rollovers stipulating that whenever a financial asset is withdrawn from a retirement account or IRA for the purpose of funding a new IRA for.

What are the IRS rules concerning capitalization and depreciation. As a result of these replacements we painted the propertys exteriors. Be sure to include enough postage to avoid having your mail carrier return your forms.

IRS Form 6252 is used to report installment sale income from a 1031 exchange that spills over into multiple tax years. Partnership Tax applies to companies or organizations that file an annual federal income tax return as a partnership and meets at least one of the following. So bottom line if you have filed a tax return for more than one year two years and have not claimed depreciation then you MUST file a form 3115 to change the method of accounting.

Reduced Business Travel Due to COVID-19 May Result in Depreciation Recapture Sept. When mailing your return. A plagiarism report from Turnitin can be attached to your order to ensure your papers originality.

You must sign your tax return in the space provided on Form 540 Side 5. If you file a joint tax return your spouseRDP must sign the tax return also. Or the capital cost of the property from his UCC and is left with a recapture of CCA of 2000 6000 - 8000 that he has to include in his business income.

179 recapture event should report the event to their owners and how a tax return preparer of an individual who receives a Schedule K-1 with supplemental Sec. Capital assets might include rental properties equipment furniture or other assets. Depreciation recapture will be a factor to account for when calculating the value of any 1031 exchange transactionit is only a.

In addition to depreciation recapture tax you may also be liable for net investment income tax which is a 38 tax on certain passive income. LIFO recapture due to S corporation election IRC Sec. Interest computed under the look-back method for completed long-term contracts Attach form FTB 3834 2.

LIFO recapture due to S corporation election IRC Sec. Depreciation recapture is a process that allows the IRS to collect taxes on the financial gain a taxpayer earns from the sale of an asset. What Is Depreciation Recapture.

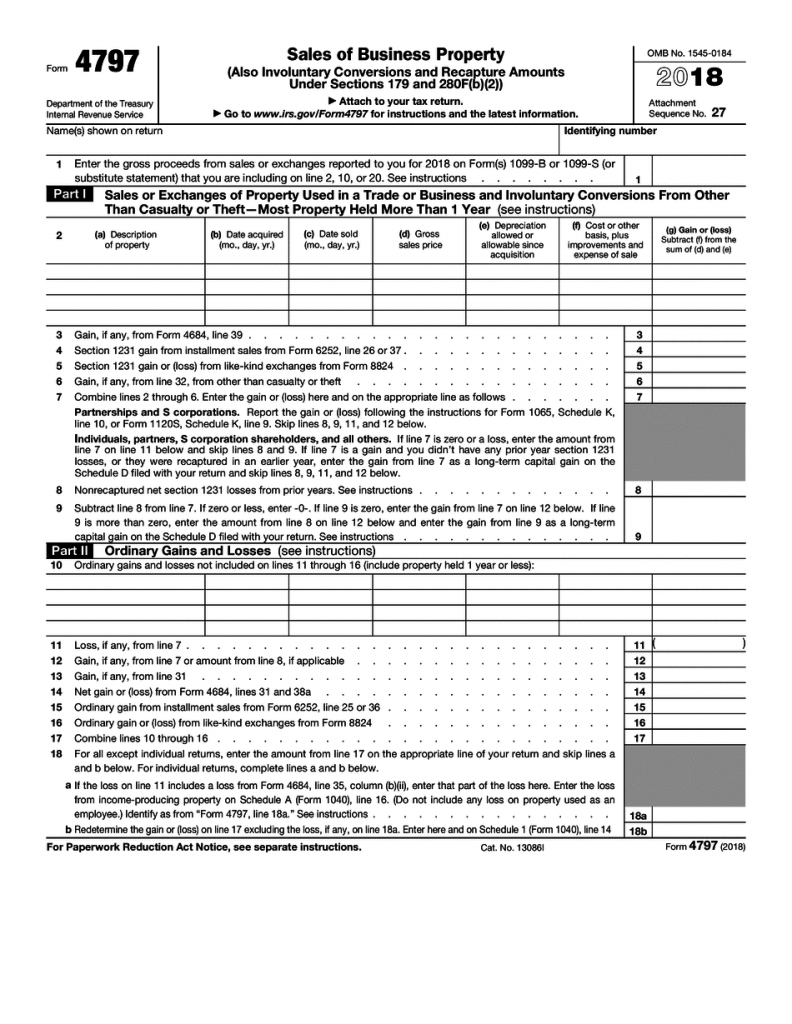

Taxable gain must be disbursed between capital gain ordinary income depreciation recapture Section 1231 gain and unrecaptured Section 1250 gain. Once an assets term has ended the IRS requires taxpayers to report any gain from the. 13 2020 with an informative live session on the complex issues surrounding tax depreciation and deductions for business aircraft.

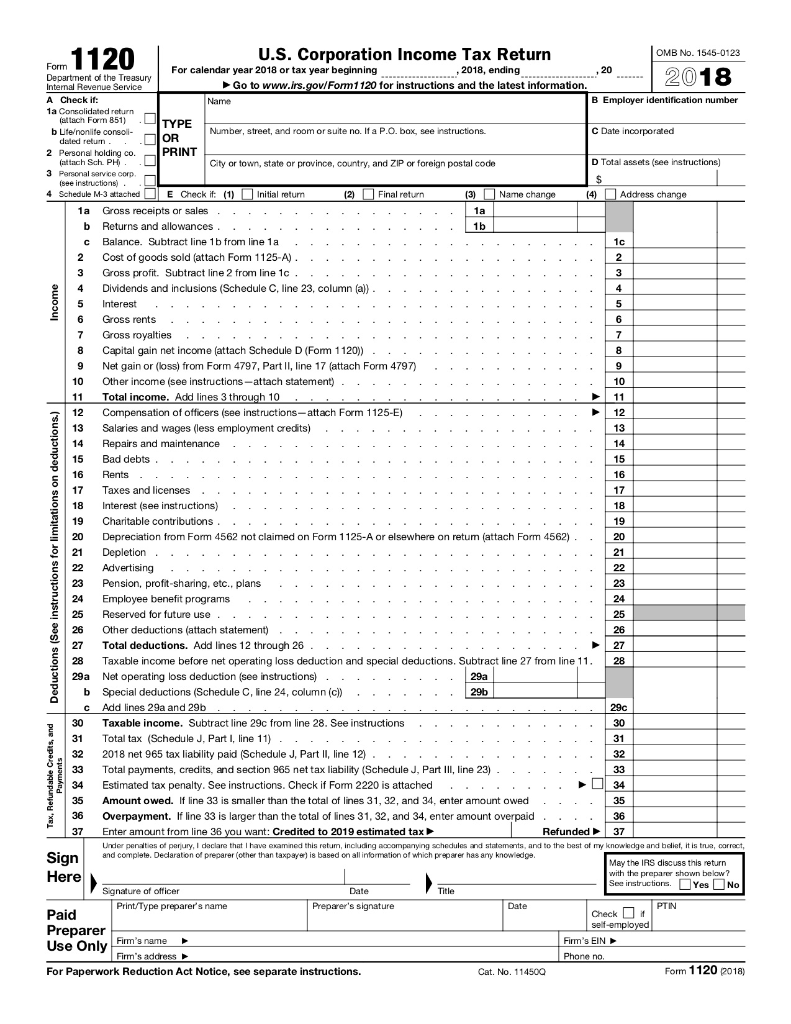

C 16 Appendix C Corporate Tax Return Problem 2 Chegg Com

Solutions To Additional Tax Return Problems Sample

What Is Bonus Depreciation A Small Business Guide The Blueprint

3 11 3 Individual Income Tax Returns Internal Revenue Service

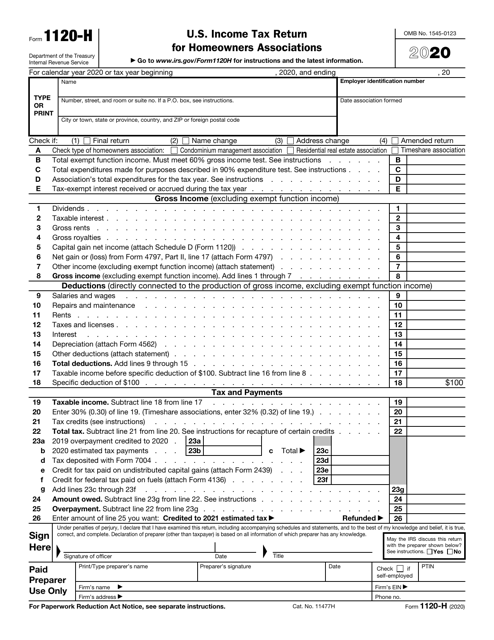

Irs Form 1120 H Download Fillable Pdf Or Fill Online U S Income Tax Return For Homeowners Associations 2020 Templateroller

3 11 3 Individual Income Tax Returns Internal Revenue Service

U S Individual Income Tax Return Forms Instructions Tax Table F1040 I1040 I1040tt By Legibus Inc Issuu

/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

3 11 217 Form 1120 S Corporation Income Tax Returns Internal Revenue Service

Irs Form To Report Sale Of Investment Property Property Walls

3 11 3 Individual Income Tax Returns Internal Revenue Service

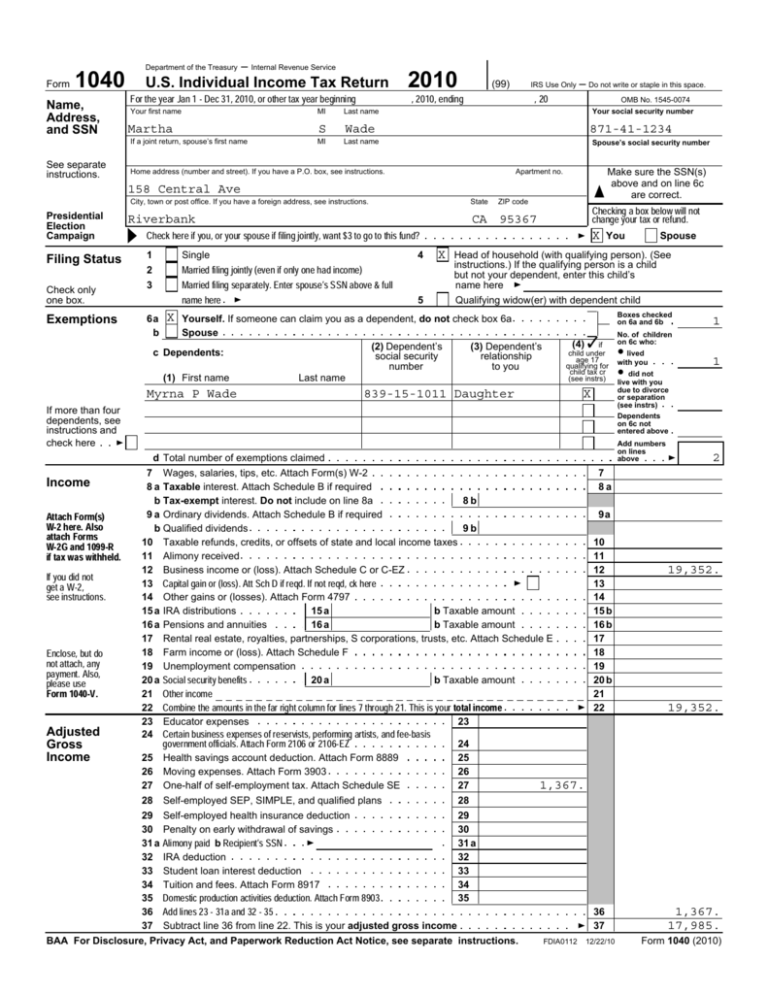

Form 1040 U S Individual Income Tax Return 2010

Checklist For Irs Form 4562 Depreciation 2016 Tom Copeland S Taking Care Of Business

3 11 16 Corporate Income Tax Returns Internal Revenue Service

3 11 3 Individual Income Tax Returns Internal Revenue Service

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

How To Fill Out A Self Calculating Form 1120 Corporation Tax Return With Depreciation Schedule Youtube

:max_bytes(150000):strip_icc()/4797-3b4366c079144f94baf030ecdfd05ed9.jpg)

Form 4797 Sales Of Business Property Definition

Post a Comment for "How To Report Depreciation Recapture On Tax Return"