Are Student Exempt From Council Tax

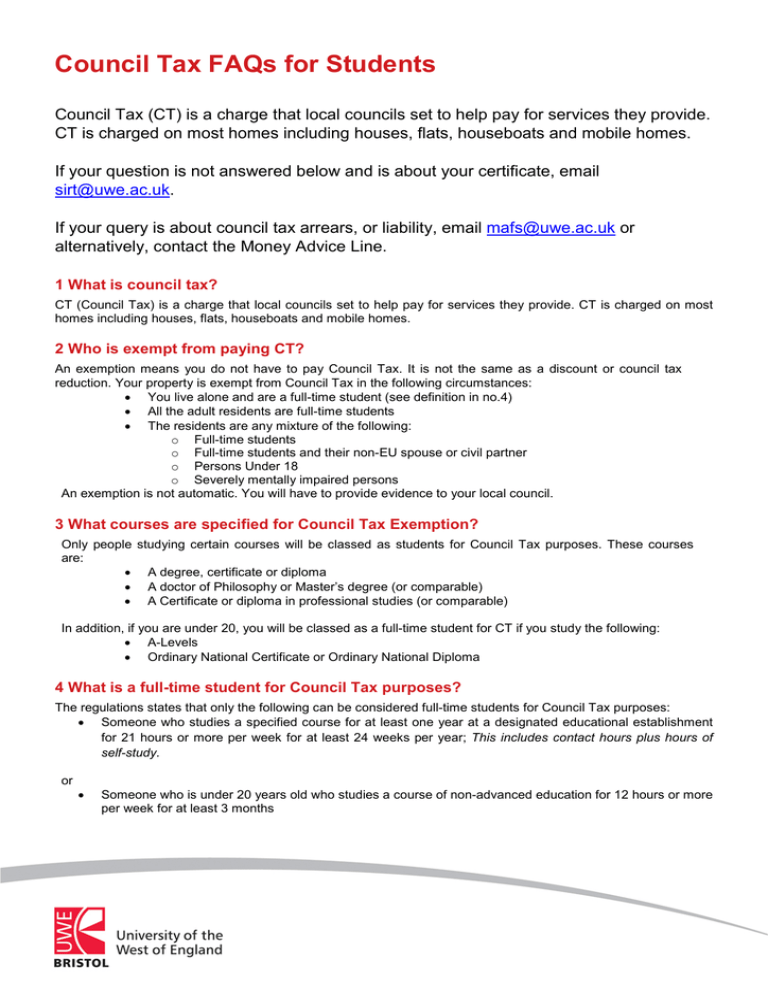

Students are exempt from council tax so you dont have to pay it. If you meet the above conditions the property will still be exempt from council tax if you leave it unoccupied eg.

Gst Rate Slabs Under Gst Law Goods And Services Goods And Service Tax Tax Rate

A full Council Tax bill is based on at least 2 adults living in a home.

Are student exempt from council tax. If you live in a Hall of Residence UCL or UofL this will be granted automatically. 18 and 19-year-olds in full-time education. People on some apprentice schemes.

Households where everyones a full-time student do not have to pay Council Tax. Are Student Loans Taxable Income. If there is one person in your household who is not a student they will qualify for a single persons discount.

These people are not counted as adults for Council Tax. Full-time college and university students. Some apprentices and trainees do not pay any council tax not even under 18-year-olds.

Your property is exempt from council tax if its only occupied by full-time university or college students. The majority of students are exempt from the liability to pay Council Tax. Some apprentices and trainees also dont pay council tax and nor do under-18s.

Part-time students will usually need to pay council tax but could be eligible for a reduction based on other factors such as being only non-full-time students in the household. Council tax for students. While students may be exempt from paying council tax they can still be liable for council tax charges.

From there they will ask you to provide your student number university name university course and your name. The UCL Student Centre can provide a Statement of Student Status for this purpose. Student halls of residence are automatically exempt.

If you are a student registered on a full-time course but have a period of part-time attendance then you should still qualify for exemption. Are student loans taxable income. If your property isnt exempt some people including full-time students are disregarded.

Many full-time students are eligible for a Council Tax exemption or discount. These include students disabled persons etc and few people the government recognises and exempts from paying council tax by law. If you do not live in a hall of residence then you will need to inform the Local Authority Council Council Tax section that you are a student.

If you live in private rented accommodation you will need to inform and provide evidence to the local authority telling them you are a student. The best way to apply for council tax exemption student is by calling up your local council and speaking to someone on the phone. To find out if.

To be classified as a full-time student you must be on a course that lasts at least a year and requires at least 21 hours of study each week. In a flat house or bedsit with other students only. If you are a student you are exempt from paying Council Tax if you live.

Any household which is occupied exclusively by full-time students will qualify for a full exemption on council tax. Full time students and others may be disregarded when council tax is calculated. If you do get a bill you can apply for an exemption.

Student loans do not count as taxable income and therefore do not count towards your personal allowance of 12570 per year. In some instances part-time students are eligible for exemption as theyre still studying for more than 20 hours a week. If youre a student and live alone or share the rent with other students you may be exempt from paying council tax.

In a flat house or bedsit on your own. Many people and properties are exempt from paying council tax mainly those who the government deem unable to pay for their council tax. How can I get 25 off council tax.

Students are exempt from paying council tax. Under 18s are not regarded as residents for Council Tax purposes. If you or someone you live with are severely mentally impaired you may be.

You might be eligible for Council Tax Reduction if you are a part-time student and on a low income. Under existing Council Tax legislation a residential dwelling which is occupied solely by full time students would be exempt for Council Tax purposes under Class N of the Council Tax exempt dwellings Order 1992. Students living in halls of residence are exempt from paying council tax.

It is also the case that dwellings which are regarded as purpose built student dwellings such as Halls of Residence are exempt under Class M of the Council Tax exempt. If youre a student but are sharing with someone who is not a student you may be eligible for council tax reduction. In a room in halls of residence.

You qualify as a full-time student if you study for at least 21 hours per week for 24 weeks of the year. See also exempt properties. Such persons and properties are discussed in the following sections.

The information to say you are a student is provided to your council by UCL. Full time students those under 20 years of age doing a qualifying part-time course and foreign language assistants. This means that if you are a student and you live on your own or you only live with students then your household will not have to pay council tax.

Students are exempt from council tax so you wont have to pay it. To count as a full-time student your course must. Out of term time.

You will not be an exempt individual as a student if you have been exempt as a teacher trainee student Exchange Visitor or Cultural Exchange Visitor on an F J M or Q visa for any part of more than 5 calendar years unless you establish to the satisfaction of the IRS that you do not intend to reside permanently in the United States and you have substantially complied with the requirements of.

Relationship Of Google Scholar Versions And Paper Citations Google Scholar Paper Lettering

Pin On Advantages Of 501c3 Tax Exempt Status

What Is Capitalized Interest On Student Loans Student Loans College Costs The Borrowers

Charitable Donation Letter Template New Donor Thank You Letter Sample Of 34 Newest Charitabl Donation Thank You Letter Thank You Letter Sample Thank You Letter

Gst Exemption Exempt Supply And Other Details Goods And Services Understanding Need To Know

Resale Certificate Request Letter Template Awesome New York State Tax Exempt Form Hotel Brilliant 25 Inspi Letter Templates Lettering Gift Certificate Template

Power To Grant Exemption From Tax Mcq On Multiple Choice Questions Choice Questions Multiple Choice Power

Pin On Videos To Help Nonprofit Organizations

How To Get Student Council Tax Exemption Save The Student

Donation Letter Template Download Free Documents For Pdf Word Excel Donation Letter Donation Letter Template Business Letter Template

Council Tax Student Exemption Applying And Payments Uni Compare

Do International Students Have To Pay Council Tax

Council Tax Student Exemption Applying And Payments Uni Compare

Grhs Youth Essay Contest Is Open To All Students Attending Public Private Parochial Or Home Schools And Accredited U Essay Contests Essay Public University

Psychology Social Sciences Nottingham Trent University Learning And Development Professional Learning

Welcome You Are Invited To Join A Webinar Join Scouts Virtual Meeting After Registering You Will Receive A Confirmation Email About Joining The Webinar Afterschool Activities Webinar School Activities

Earn Up To 77 000 Per Year As A Golf Ball Diver Golf Ball Ball Diver

Reflecting On Digital Literacy Digital Literacy Literacy Assessment Tools

Post a Comment for "Are Student Exempt From Council Tax"