Is A Minister's Salary Taxable

Thus a minister may have to pay a self-employment tax one to four times per year depending on the number of employees in his church. When a church pays the minister allowances it does so thinking that it is allowed to pay for these items as tax free allowances.

Ultimate Tax Guide For Ministers The Official Blog Of Taxslayer

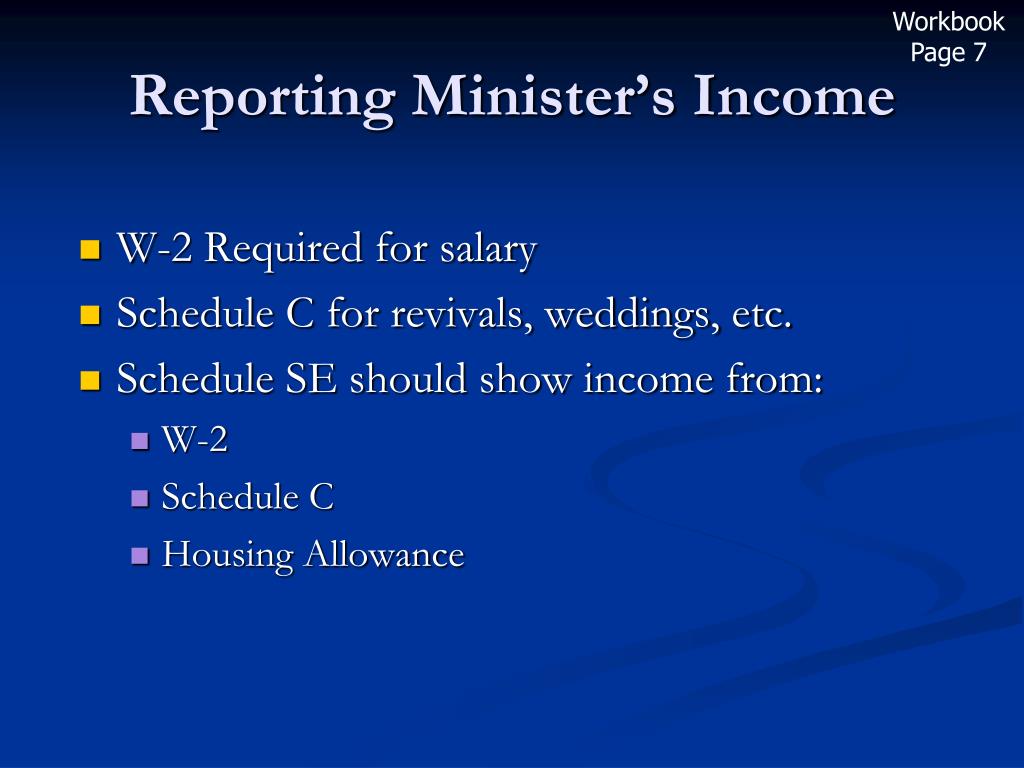

Reportable taxable PIT wages are shown in box 1 of Form W-2.

Is a minister's salary taxable. From a personal income perspective the first thing to understand is that the income tax code takes the position that any money paid to or for an employee is income unless specifically excluded by the tax code. As such the church would not need to file any special forms. Yes you can do that.

A pastor has a unique dual tax status. Employee Benefit Programs. These amounts are fully taxable for income tax reportable on Form W-2 Box 1 and SECA purposes.

A church can pay a pastor a benefit to help cover the cost of SECA taxes but that benefit would be considered taxable income to the pastor. While they can be considered an employee of a church for federal income tax purposes a pastor is considered self-employed by the IRS. In this scenario with the pastor at 60000 in 2019 I would set the pastor at 75000 in 2020 90000 in.

Members of the clergy ministers members of a religious order and Christian Science practitioners and readers and religious workers church employees must pay self-employment tax SE tax. Section 107 of the Internal Revenue Code allows ministers of the gospel to exclude some or all of their ministerial income designated by their church or church-related employer as a housing allowance from income for federal income tax purposes. A ministers housing allowance sometimes called a parsonage allowance or a rental allowance is excludable from gross income for income tax purposes but not for self-employment tax purposes.

Ministers who are paid a salary are generally considered employees for personal income tax PIT. The Pastor or church determines the amount of the contribution which would exclude it from taxes. Ministers are exempt from income tax withholding whether they report their income taxes as employees or self-employed.

If you receive as part of your salary for services as a minister an amount officially designated in advance of payment as a housing allowance and the amount isnt more than reasonable pay for. In short a minister must pay taxes like a self-employed worker but they are not eligible for all the tax benefits many self-employed workers enjoy. Under the law these allowances are 100 taxable and must be reported in the ministers Form W-2.

So if a church desires to cover the entire SECA obligation the allowance would need to be grossed up to cover the taxes. This costs the church nothing. The tax code specifies that the housing allowance of a min - ister who owns or rents a home is nontaxable in computing fed - eral income taxes to the extent that it is 1 declared in advance.

An ordained minister is a common law employee of a church for income tax purposes and is taxed on offerings wages and fees for ministerial services. Pension Fund provides Pension Plan and an array of retirement savings and health care programs for ministers and lay employees. Ministers who report their income taxes as an employee can request voluntary withholding by submitting a Form W-4 to the church.

Well cover the exemption process next. Tuition Benefits for your dependents The school must also be the employing body in order for this to be a tax-free benefit ie. The church and school are one corporation.

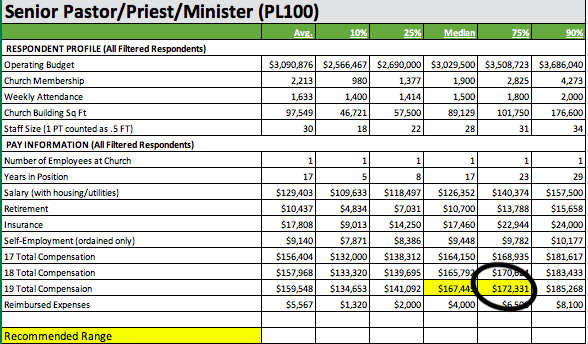

Salary ranges can vary widely depending on many important factors including education certifications additional skills the number of years you have spent in your profession. Taxable income to the minister. The congregation should consult an attorney and possibly a tax advisor before entering into any of these arrangements.

It is simply a matter of designating part of a ministers salary as a housing allowance. The remaining 30000 is salary. However in almost every other aspect of the law ministers are considered employees.

How a ministers income is taxed. It would be lumped together with the pastors other taxable income on the W-2 regardless of the churchs intent for the money. Ministers rarely qualify to opt out of social security.

What every minister needs to understand about their income. ALL ministers pay under the SECA system it is not optional. In addition to a pastors base salary there are some items the church may provide as fringe benefits to the pastor or other employees that the IRS may include as income.

If you are a minister of a church your earnings for the services you perform in your capacity as a minister are subject to self-employment tax unless you have requested and received an exemption. A sabbatical can be considered paid time off and compensation related to the time off is fully taxable. Salaries and fees for your ministerial services.

With more online real. Opting out of social security. This might be new for you but literally if the year is 2019 you can create a chart that sets the pastors salary for 2020 2021 and 2022 right now.

First all ministers by the IRS definition are dual status taxpayers. The average Pastor salary in the United States is 100095 as of October 29 2021 but the range typically falls between 82260 and 113437. Read more about the rules and limits.

However the extent of paid time off should be reasonable considering the pastors tenure with. A sabbatical is generally a vacation and can be offered at will by the church. That means that you pay income taxes as an employee but pay payroll taxes Social Security and Medicare taxes as if you were self-employed.

The following income is included in the SE tax calculation on Schedule SE. Regardless of whether youre a minister performing ministerial services as an employee or a self-employed person all of your earnings including wages offerings and fees you receive for performing marriages baptisms funerals etc are subject to income tax. Self-employed people pay these taxes under the SECA system.

Some pastors are considered independent contractors if they arent affiliated with one specific church like traveling evangelists. Ministers as employees. That means the church who is the ministers employer does not withhold income tax from the ministers wages.

They can receive taxable allowances for vehicles or education and participate in pretax retirement plans and cafeteria plans.

The Pastor S Wallet Complete Guide To The Clergy Housing Allowance Artiga Amy 9798621530662 Amazon Com Books

Designating A Housing Allowance For 2021

How Pastors Can Claim The Earned Income Tax Credit The Pastor S Wallet

![]()

Minister S Housing Allowance Relate To Self Employment Tax

Church And Christian Ministry Compensation Concepts B Y Corey A Pfaffe Cpa Phd Spring Ppt Download

How To Set The Pastor S Salary And Benefits Leaders Church

Compensation Guide Minister S Program

Compensation Guide Minister S Program

Ppt Basic Tax Seminar 2012 Powerpoint Presentation Free Download Id 3072121

Church And Christian Ministry Compensation Concepts B Y Corey A Pfaffe Cpa Phd Spring Ppt Download

Compensation Guide Minister S Program

Designating All Salary As Housing Allowance

Church And Christian Ministry Compensation Concepts B Y Corey A Pfaffe Cpa Phd Spring Ppt Download

Ultimate Tax Guide For Ministers The Official Blog Of Taxslayer

Post a Comment for "Is A Minister's Salary Taxable"