Depreciation Straight Line Method Class 11

Straight line method over the propertys AMT class life. Cement division of M Ltd.

How To Calculate Straight Line Depreciation Method Youtube

Any other tangible property.

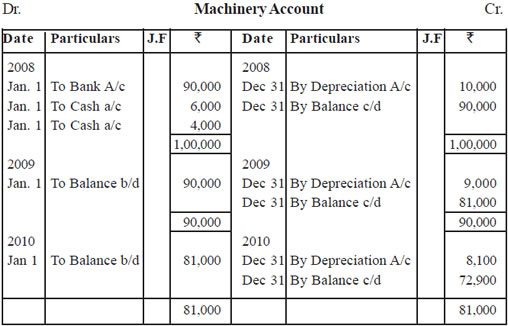

Depreciation straight line method class 11. Is following written-down value method for providing depreciation. 150 declining balance method switching to the straight line method the first tax year it gives a larger deduction over the propertys AMT. Wants to provide depreciation on straight line method.

Tangible property other than section 1250 property depreciated using the straight line method for the regular tax. During accounting year 03-04 M Ltd. Is in manufacturing of steel.

4 Solved Numerical Question With The Help Of Straight Line Method Of Depreciation Taimoor Khalid Youtube In 2020 This Or That Questions Straight Lines Method

Depreciation Formula Calculate Depreciation Expense

Depreciation Methods 4 Types Of Depreciation You Must Know

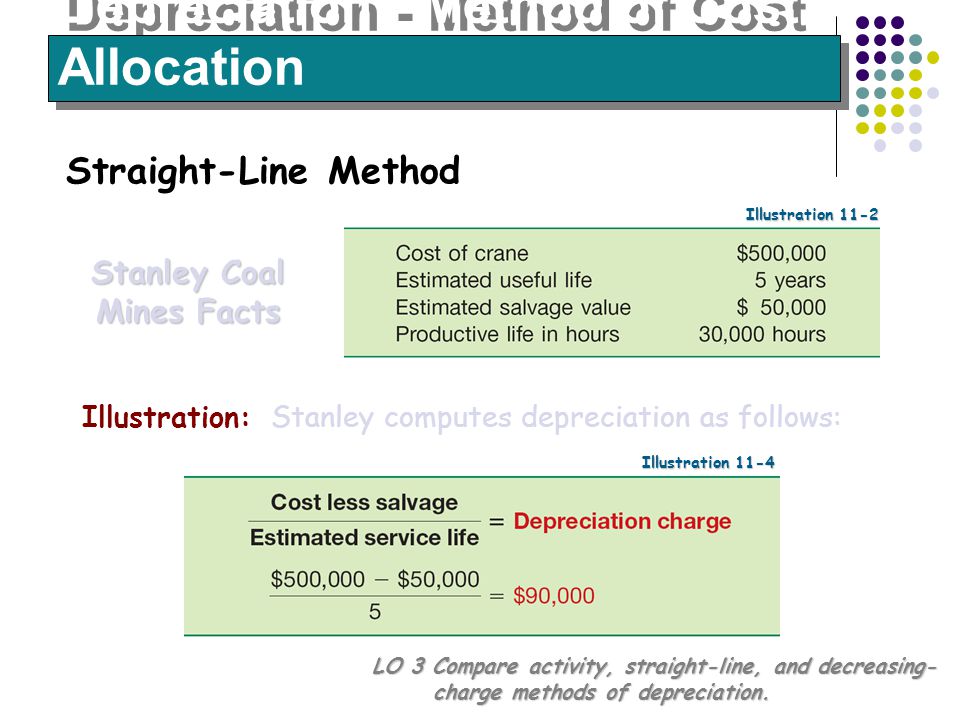

Depreciation Impairments And Depletion Ppt Video Online Download

What Is Straight Line Depreciation And Why Does It Matter

Straight Line Vs Reducing Balance Depreciation Youtube

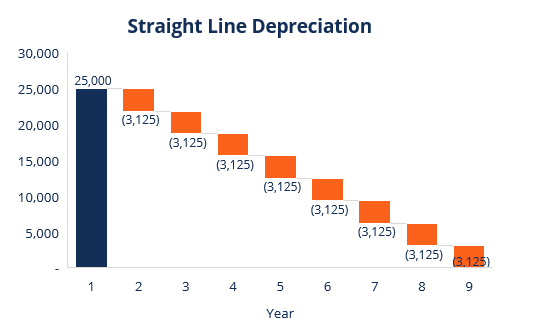

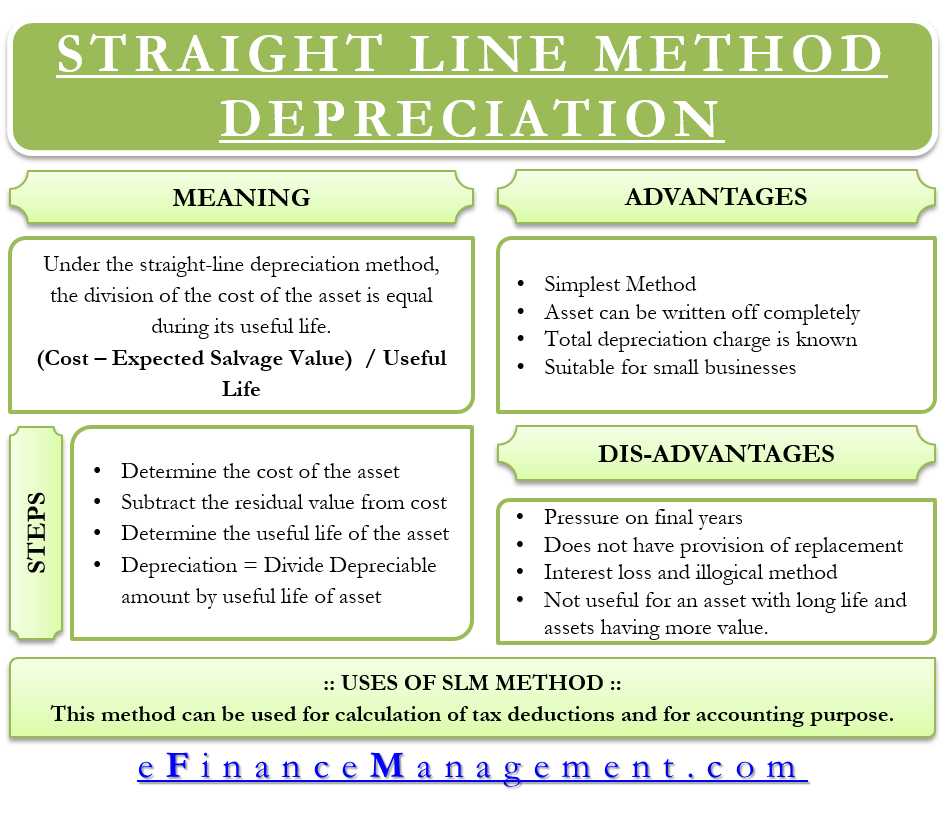

Straight Line Depreciation Efinancemanagement

How To Calculate Straight Line Depreciation Depreciation Guru

Depreciation Formula Examples With Excel Template

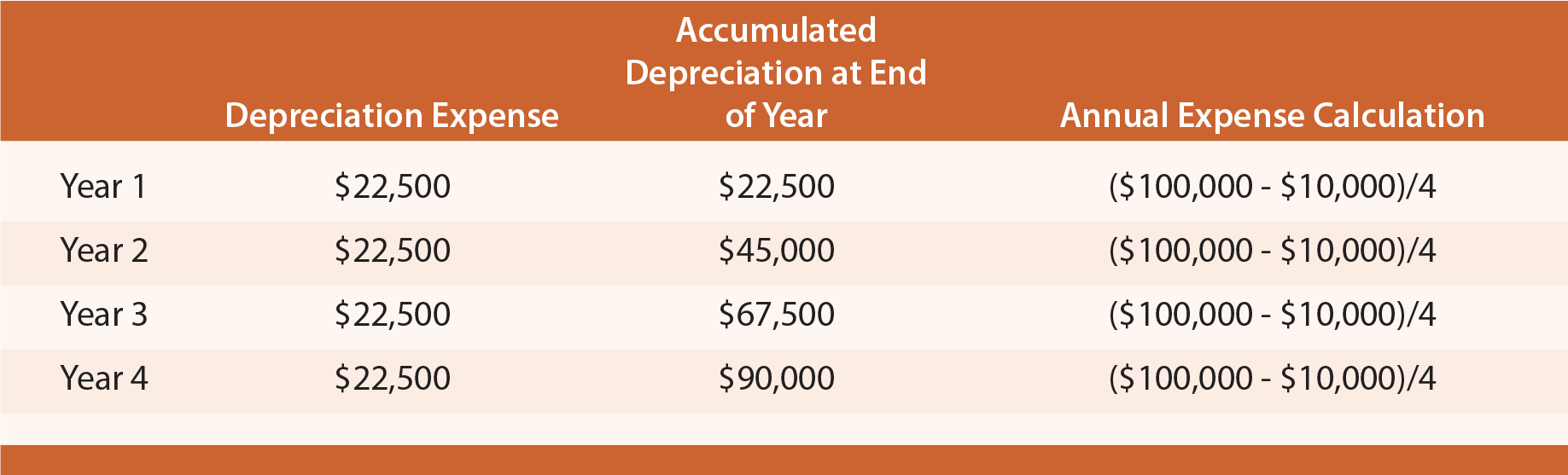

Bus202 Depreciation And Depreciation Methods Saylor Academy

Depreciation Methods Principlesofaccounting Com

Straight Line Depreciation Method Formula Example Video Lesson Transcript Study Com

Straight Line Depreciation Method Or Original Cost Method Formula Solved Example

Depreciation Straight Line Method Or Original Cost Method Lecture 1 Youtube

Depreciation Straight Line Method Purchase And Sale Of Asset During The Year Accounts Youtube

Straight Line Depreciation Bookkeeping And Accounting Accounting Basics Learn Accounting

Chapter 20 Depreciation Of Fixed Assets Nature And Calculation Ppt Download

Post a Comment for "Depreciation Straight Line Method Class 11"