Can A C Corp Carry Forward Losses

In order to prevent trafficking in net operating losses NOLs tax rules place potentially severe limitations on the use of a companys tax losses. And even mature companies can have loss years.

Acquiring The Tax Benefits Of A Corporation Journal Of Accountancy

It may be offset against the income of its subsidiaries if any if a consolidated return is filed carried back against past income or carried forward to reduce future income.

Can a c corp carry forward losses. Under prior law a calendar-year C corporation with taxable income or loss of 400 500 and 100 in successive tax years would be able to carry back 400 of the 500 loss in year 2 to fully offset the 400 of taxable income in year 1 and carry forward the remaining 100 of the loss to fully offset taxable income in year 3. Therefore you will not be able to use these losses on your personal return. Say Thanks by clicking the thumb icon in a.

If your business ends up running at a loss for the year you may be able to deduct the losses from your other income. The maximum loss you can carry forward for a year is 80 of taxable income modified by removing some deductions. C corporations may carry a net capital loss back three years and forward up to a maximum of five years.

Particularly companies in cyclical industries. If you choose to waive the carryback for a tax year your choice is irrevocable. When an asset is sold.

Tax Loss Carryforward. Your company can apply these losses to its total profits. Corporate Net Operating Loss Carryforward and Carryback Provisions by State.

More bad news- Normally Net Operating Losses NOLs can be carried forward and used in future years for C Corps. See this link to IRS Publication 536 Net Operating Losses NOLs for Individuals Estates and Trusts. Net Operating Loss NOL Computation and NOL and Disaster Loss Limitations Corporations FTB 3805Q 5.

The calculation is one that you will have to do on your own using IRS Form 1045. Capital losses of C corporations may only be deducted from corporate capital gains and not from regular corporate income. For more information about corporate capital losses see Capital Losses in Pub.

Such a loss can only be used by the corporation itself. The use of Illinois net losses to offset income for tax years ending on or after December 31 2012 and before December 31 2014 is limited to a maximum deduction of 100000 per year for Corporations. This enables members and shareholders to utilize the profits and losses to their best benefit over multiple years not just the current year.

These provisions are called net operating loss NOL carrybacks and carryforwards. Early stage companies often incur tax losses in their first few years of existence. Such term shall include any corporation entitled to use a carryforward of disallowed interest described in section 381c20.

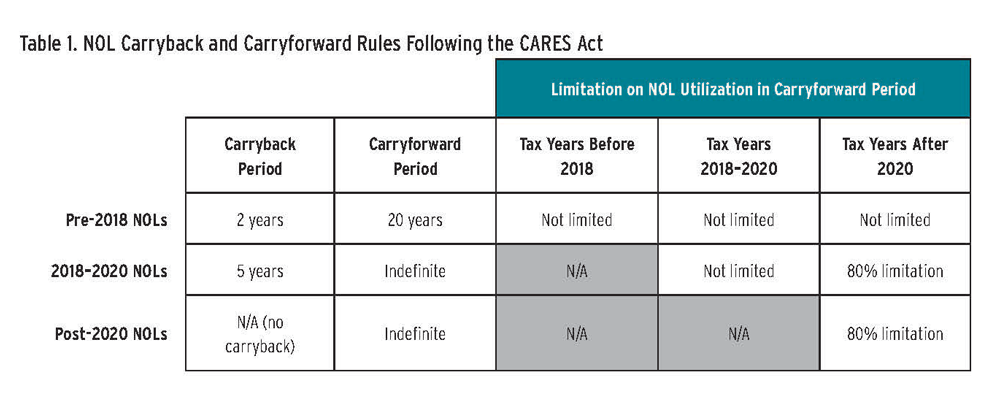

The Coronavirus Aid Relief and Economic Security Act CARES Act amended section 172 b 1 to provide for a carryback of any net operating loss NOL arising in a taxable year beginning after December 31 2017 and before January 1 2021 to each of the five taxable years preceding the taxable year in which the loss. Illinois net losses are used in order of expiration beginning the first year with taxable income after the loss year. If you earn money through self-employment you report it on Schedule C.

You may have NOL for the year if your adjusted gross income on your tax return is less than your deductions the standard deduction or itemized deductions. Questions and Answers about NOL Carrybacks of C Corporations to Taxable Years in which the Alternative Minimum Tax Applies. There is no limit on the number of tax years a RIC is allowed to carry forward a net capital loss incurred in tax years beginning after December 22 2010.

Up to 10 cash back If your business is organized as a C corporation any NOL it suffers provides no tax benefit to the shareholders. A tax loss carryforward is a tax policy that allows an investor to use realized capital losses to offset the taxation of capital gains in future years. If your company has unused losses from its property business it can generally carry them forward to future accounting periods.

On the other hand unused NOLs will be lost forever with an S corporation election unless the C Corp can use it for previous years through amended tax returns. Losses and deductions in excess of this aggregate amount are suspended and carried forward indefinitely until the basis limitations allow them to deduct them. A C corporations excess capital loss in any given year is carried to other years in the following order.

For Illinois net losses in tax years ending on or after December 31 2003 Illinois net losses can no longer be carried back and can only be carried forward for 12 years. If the taxpayer has sufficient basis to take the losses and deductions they must then determine whether their ability to utilize these items is restricted by the at-risk rules. S corporations have a.

This is taken from CFIs e-commercestartup financial modeling course in which a company has the ability to carry forward losses due to the significant losses expected to be incurred by the business in its first few years of operation. You can however choose not to carry back an NOL and only carry it forward. If part of a capital loss remains after carrying it forward up to five years it is lost forever.

The C corp loss carryforward is suspended pending the conversion of the S corp back to a C corp. Fortunately the tax law generally provides that operating losses can be carried back 2 years or forward 20 years. When businesses suffer losses in a calendar year well-structured corporate tax codes allow them to deduct those losses against previous or future tax returns.

It doesnt automatically carry forward or back to other tax years. First 3 years prior. The term loss corporation means a corporation entitled to use a net operating loss carryover or having a net operating loss for the taxable year in which the ownership change occurs.

Unfortunately carry forward losses of a C Corporation can only be used by the same C Corporation or another C Corporation into which the first C Corporation is merged. C corporations must follow a specific order when carrying capital losses back and forward. The loss cannot pass through to the S corp shareholders.

Check the box in Part I Election to waive carryback on your. If the corporation holds real property the at-risk rules apply to. The intervening years DO count in the expiration period of the NOL.

In some cases however youll have to either carry the loss forward and deduct it. However there is a glimmer of light in this. Unlike the capital loss treatment for individuals where capital losses in excess of 3000 may only be carried forward capital losses of C corporations may be carried back three years and forward five years.

A key benefit to pass-through entities is the ability to carry forward or carry back losses associated with the S corporation.

Nol Carrybacks Under The Cares Act Tax Executive

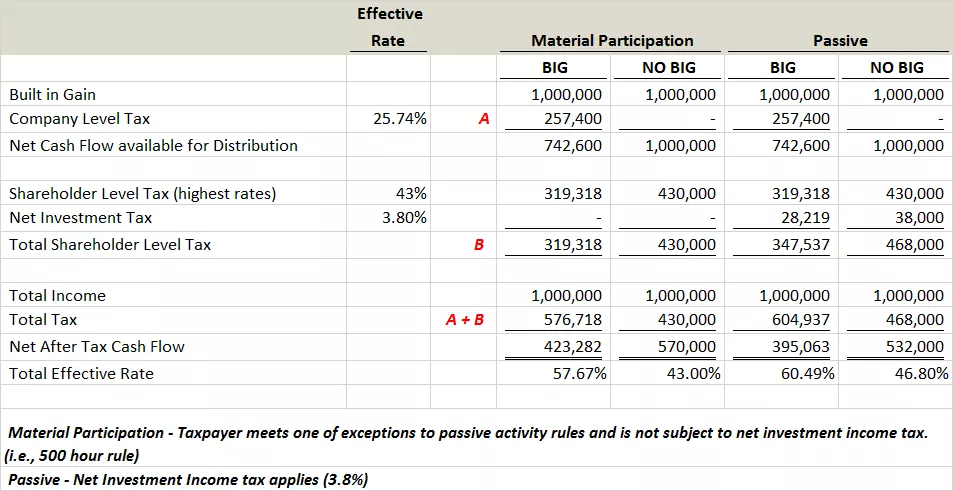

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Can You Deduct Your S Corporation Losses

Carry Your Losses Further Forward Journal Of Accountancy

What Is A C Corporation What You Need To Know About C Corps Gusto

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

I Think I Found Him He S Been Right In Front Of Me This Whole Time I Didn T See It Until Now The Only Man Good Man Quotes Real Love Quotes Found You

Consolidated Group Tax Allocation Agreements The Cpa Journal

Oh How The Tables May Turn C To S Conversion Considerations Stout

Tax Treatment For C Corporations And S Corporations Under The Tax Cuts And Jobs Act Smith And Howard Cpa

Tax Consequences To Avoid When Converting From Llc To C Corp Indinero

10 Tax Benefits Of C Corporations Guidant

Northrop All Wing Airplane Patent Vintage Airplane Airplane Blueprint Airplane Art Pilot Gift Aircraft Decor Airplane Poster Airplane Art Vintage Airplanes Airplane Poster

Tax Consequences To Avoid When Converting From Llc To C Corp Indinero

B 2 Bomber Patent Airplane Blueprint Aviation Art Airplane Art Pilot Gift Aircraft Decor Airplane Poster Northrop Air Force Airplane Art Pilot Gifts Airplane Poster

What Is A C Corporation 5 Facts

What Are Net Operating Loss Nol Carryforwards Tax Foundation

Oh How The Tables May Turn C To S Conversion Considerations Stout

Post a Comment for "Can A C Corp Carry Forward Losses"